- ETPs and ETFs had inflows for the second week running, according to CoinShares.

- Digital asset investment products saw inflows of nearly $80 million last week.

Happy Monday!

Digital asset fund flows are starting to pick up after breaking a six-week losing streak. Last week saw the largest inflows since July, according to digital asset manager CoinShares.

Let’s get into it!

Exchange-traded fun

Investors are warming on exchange-traded products and funds.

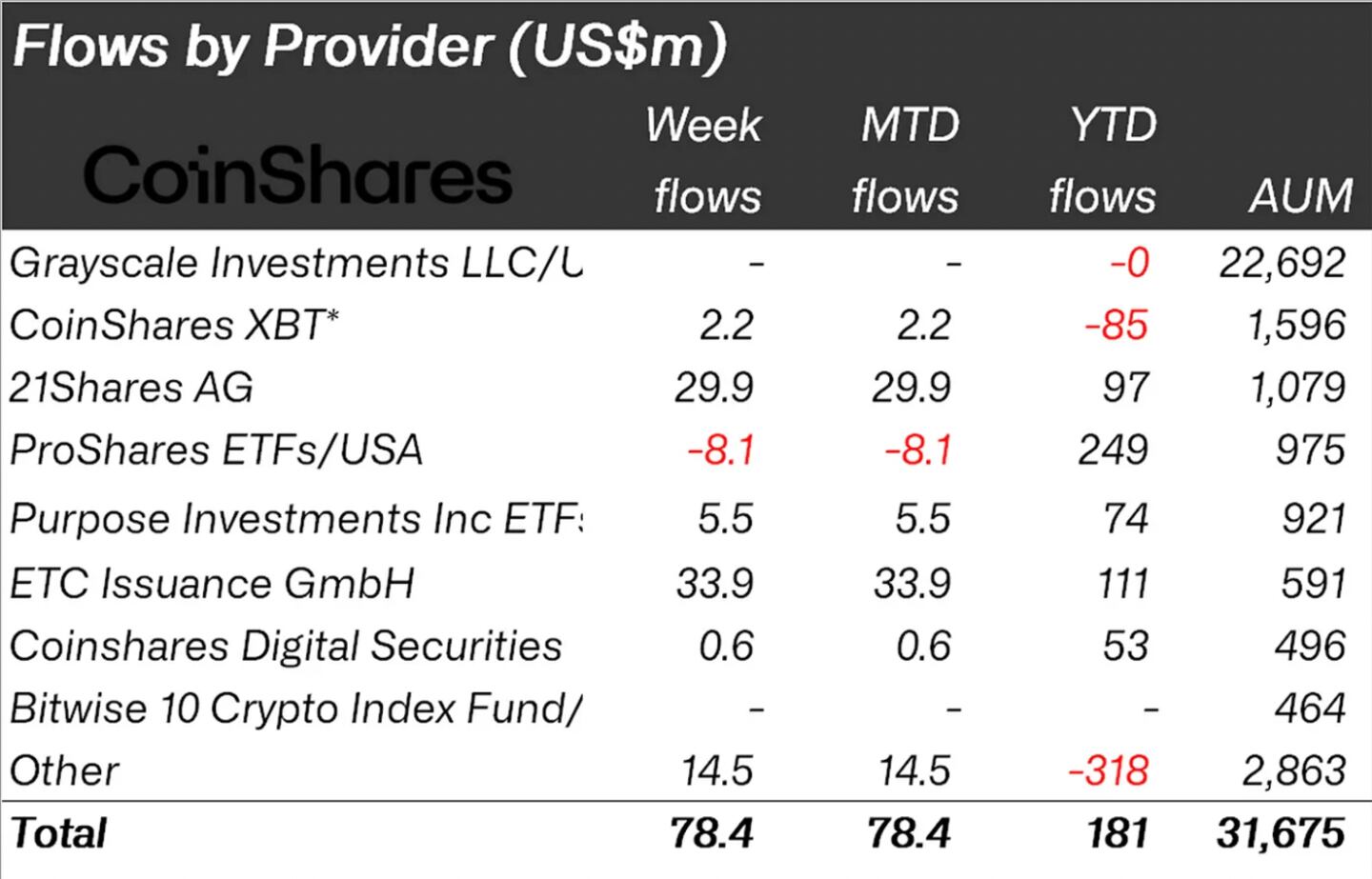

Funds experienced inflows of $78 million, James Butterfill, head of research at CoinShares, said in a report Monday.

This follows six weeks of outflows from digital asset funds between August and September.

Trading volume soared by 37% to $1.1 billion over the week.

“Bitcoin was the main beneficiary, seeing inflows totalling $43 million last week,” the report noted.

Bearish investors added to short positions — inflows to short products, funds that profit from a decline in price, were $1.2 million over the week.

Any decision around a spot Bitcoin ETF in the US is likely to be pushed out until 2024, but not before Grayscale’s case is dealt with.

The digital asset manager won its case against the US Securities and Exchange Commission in August, and the regulator has until this Friday, October 13, to appeal this decision.

Grayscale’s win improved analysts outlook on a spot product being approved, but failed to improve prices beyond a short-lived bounce.

However, investor confidence has been buoyed the upcoming halving in April, and the recent delay in Mt. Gox bankruptcy repayments — which would have seen nearly $4 billion worth of Bitcoin returned to investors.

“Regionally, the divide continues, with 90% of inflows from Europe, while the US and Canada saw just $9 million inflows combined, suggesting a continued divergence in sentiment,” Butterfill said.

While six Ethereum ETFs went live in the US last week, there was “tepid appetite” for the funds.

Trading was heavily concentrated in VanEck and Proshares’ ETFs, which have $8.2 million and $6.3 million in assets under management, respectively.

Solana ETPs, mainly trading in Europe, attracted inflows of $24 million over the past week. It continues to “assert itself as the altcoin of choice,” Butterfill said.

Crypto market movers

- Bitcoin fell 1.2% to trade around $27,500.

- Ethereum traded just below $1,600 after it shed 1.7%.

- Altcoins experienced sharper sell-offs as liquidity conditions exacerbated prices moves. Ripple’s XRP token dropped 4.2% while Solana’s SOL plunged 4.6%.

What we’re reading

- SBF lawyers brace for most important witness in second week of trial: TRM Labs’ Ari Redbord — DL News

- How SBF’s fraud trial will slow US crypto bills — DL News

- Stablecoins are a lot like money market funds — and that could be a problem, Fed researchers say — DL News

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.