- Bitcoin traded higher as the dollar dipped amid optimism around rate cuts.

- Meanwhile Binance’s settlement removed an element of risk from the market.

- Coinbase shares soared in the week since the DOJ settlement on improved sentiment.

The US dollar dipped as markets reassessed the interest rate outlook for 2024, pushing Bitcoin higher again.

Let’s dig in!

Interest rate hopium?

Bitcoin flirted with levels above $38,000 overnight with several potential drivers attributed to the move.

“The most obvious one is the decline in the US dollar as rates expectations shift,” Noelle Acheson, author of the Crypto is Macro Now newsletter and former head of market insights at Genesis wrote on Wednesday.

Market participants appear to have turned optimistic on potential rate cuts following comments from US Federal Reserve officials. Hedge fund manager Bill Ackman told David Rubenstein on Tuesday that he expects rate cuts “sooner than people expect,” or as early as the first quarter.

Christopher Waller, one of the Fed’s more hawkish members, said “policy is currently well positioned to slow the economy and get inflation back to 2%,” in a speech at the American Enterprise Institute on Tuesday.

“II still don’t understand why the market thinks cuts are in the Fed’s short-term plans, when everything officials have said recently hints at the opposite,” Acheson said, before adding that “the market has definitely spoken.”

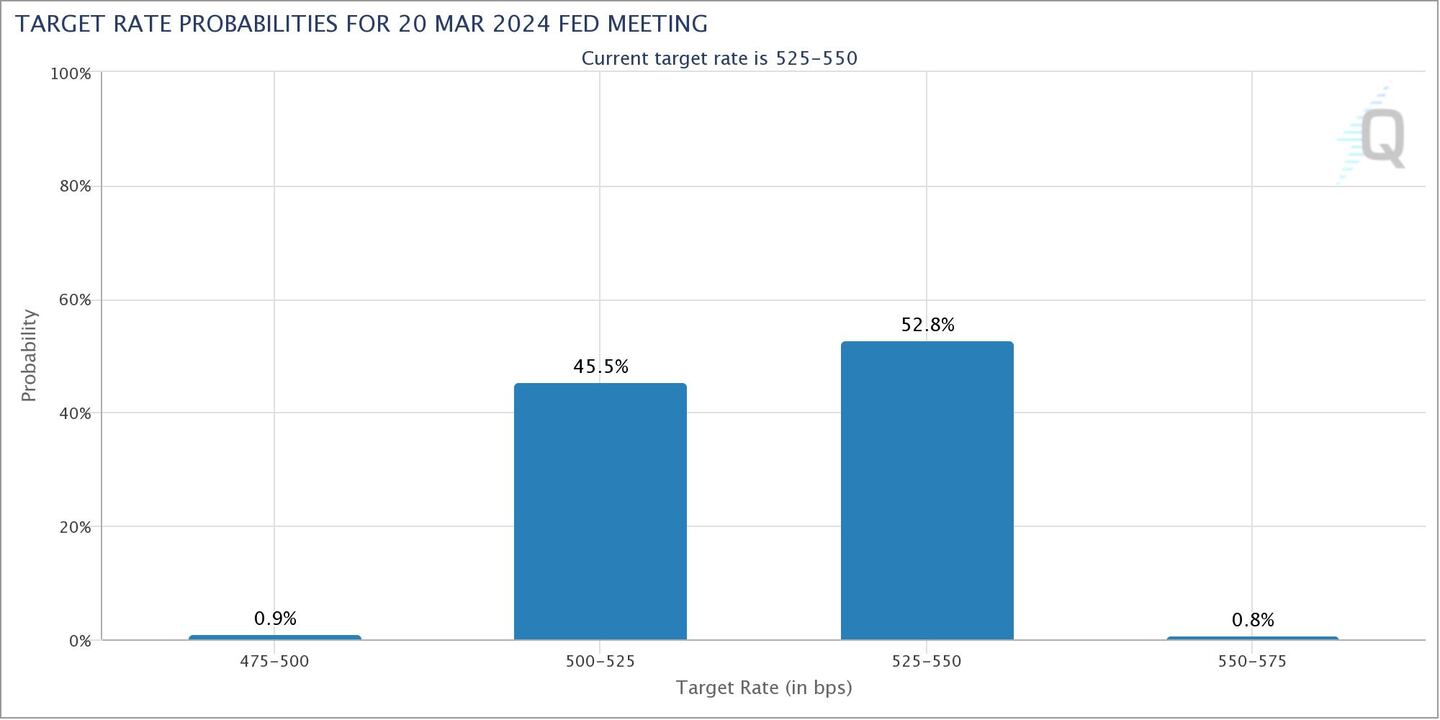

There is now a 45% probability that the central bank cuts the interest rate at its March 20 meeting, up from 27% seven days ago, according to the CME’s FedWatch tool — which analyses futures pricing.

Treasury yields and the dollar slipped. The dollar index has fallen around 3.5% in the past month, reaching its lowest level since August.

“This should boost dollar-denominated commodities, including Bitcoin,” Acheson said.

Binance’s $4.3 billion settlement also contributed to the move, she said, adding that “there is now virtually no danger that Binance will collapse.”

“The immediate impact on volumes and liquidity was muted,” as Bitcoin and Ethereum edged higher after the Binance deal, Kaiko said in a report this week.

“The removal of this uncertainty and the evidence that the market is unaffected is most likely giving investors more confidence that the drama of 2022 may finally be behind us,” Acheson wrote.

Coinbase’s share price has soared 20% in the past week since Binance’s settlement, as well as similar tailwinds to Bitcoin.

The recent move in the exchange’s stock is related to the Binance settlement, Needham and Co analyst John Todaro told DL News. This “reduces competitive pressure” as well as higher crypto prices and volume, and expectations of a spot Bitcoin exchange-traded fund.

Crypto market movers

- Bitcoin rose 1.2% to around $37,800.

- Ethereum was back above $2,000 after gaining 0.2%.

What we’re reading

- Philippines to block Binance for failing to get licenced and rein in ‘influencers and enablers’ — DL News

- Chandler Guo’s EthereumPoW prediction is way off one year later — DL News

- Ronaldo Faces Lawsuit For Promoting Crypto Exchange Binance — Milk Road

- Velodrome And Aerodrome DEXs Suffer Frontend Attacks — Milk Road

- DCG Agrees to Pay Genesis $275 Million by April 2024 — Unchained

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.