- FTX could start to sell some of its crypto holdings, a significant portion of which are altcoins.

- Investors have been speculating how much could hit the market.

- QCP Digital expects prices to drop below $23,000 next month.

Happy Tuesday!

Crypto investors will digest potential sell side pressure related to the bankruptcy proceedings of collapsed crypto exchange FTX ahead of Wednesday’s court hearing. Crypto trading platform QCP Capital expects macro headwinds to combine with selling pressure to send prices lower heading into the final quarter of the year, with Bitcoin potentially going below $23,000.

Let’s dig in!

FTX token sales

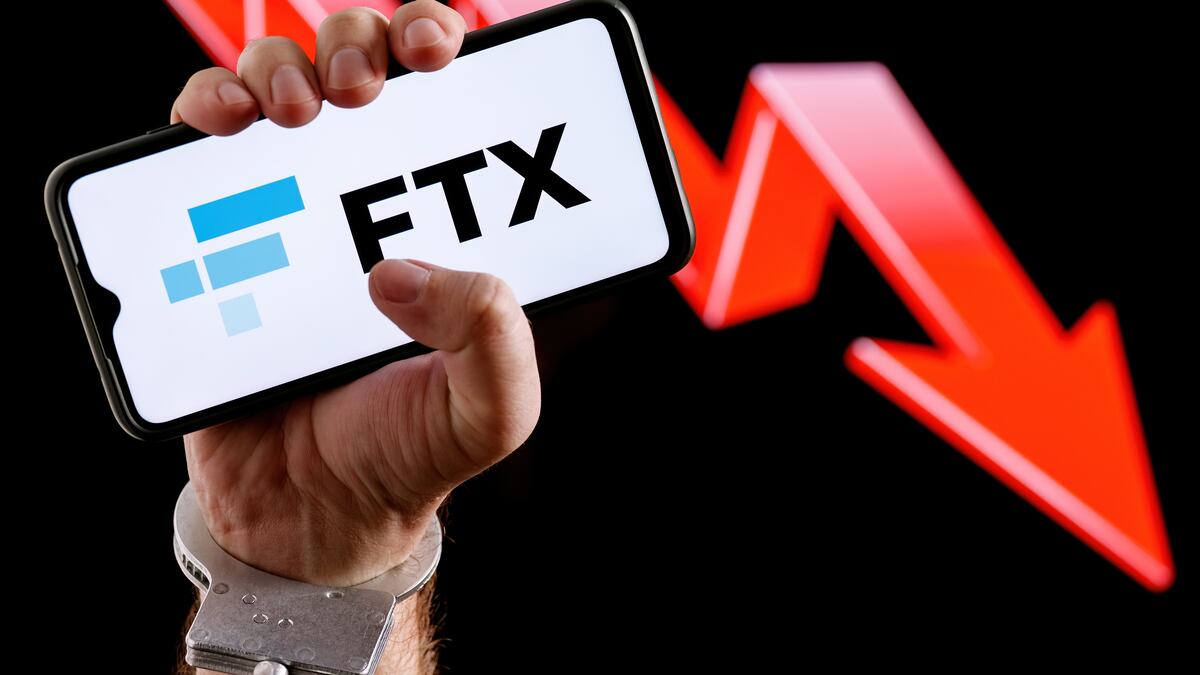

The collapse of FTX continues to send shockwaves through crypto markets. Investors are braced for selling pressure as the exchange seeks permission to offload some of its crypto holdings as part of its bankruptcy proceedings.

FTX filed an application to sell some of its tokens in August.

Any sales will be handled by Mike Novogratz’s Galaxy Digital and will be capped weekly. Liquidations will be limited to $50 million for the first week, and $100 million each subsequent week, according to court filings. This limit could potentially increase to $200 million.

FTX’s crypto holdings include around $1.16 billion of Solana’s SOL token.The majority is locked and will unlock in tranches between 2025 and 2028, meaning around $216 million of this is liquid and could hit the market.

Alameda’s held 42,169,693 SOL in locked stake at the time of its bankruptcy, according to the Solana website. Its holdings represented around 74% of all locked stake.

“Given they are subject to Chapter 11 bankruptcy it is unlikely this stake will immediately move once unlocked, until the liquidation process is completed. Similar cases have taken as much as 10 years to complete,” the website noted.

The potential sell off spooked markets on Monday and drove the price of SOL lower by as much as 4%. It has since recovered some of its losses and is up 1.6% over the past 24 hours.

Crypto derivatives platform Paradigm said Monday that the market decline was “probably due to discussions around FTX liquidations.”

Selling pressure could be mitigated by investors buying the defunct exchange’s assets over-the-counter. This means the sale would be done via a broker rather than directly on the market.

Tron’s Justin Sun said Monday he was contemplating an offer for FTX’s holding and assets to “reduce their selling impact on the crypto community.”

“I can buy those TRX tokens via OTC. So we are fine,” Sun said in response to an overview of assets related to FTX from Messari’s Ryan Selkis.

‘Imminent final decline’

Crypto trading platform and market maker QCP Capital shared a bearish outlook for the final quarter of 2023 on Tuesday.

“[We] expect an imminent final decline to close out the quarter at the lows,” the firm said in a market update. The firm expects Bitcoin to trade just below $23,000 by October based on its outlook.

A combination of crypto and macro events combined with a “concentration of upcoming bearish events,” are behind the dim outlook, this includes higher-than-expected US inflation data that’s expected on Wednesday.

QCP expects the US Federal Reserve to be “more-hawkish-than-expected,” at its meeting on September 20. The central bank is widely expected to pause interest rate increases next week.

FTX token asset sales and Mt. Gox bankruptcy repayments over the next month will “cap things off,” the firm said.

“Hence while our theory implies a bottom early next month, we think the true bottom will come in mid-late October when the bad news cycle has run its course,” its market update said, QCP remains bullish following that and into the first quarter of next year.

Crypto market movers

- Bitcoin recovered overnight to trade above $25,000 after falling below this level for the first time in three months on Monday.

- Ethereum continued to trade down overnight, it slipped 0.2% to traded around $1,580.

- Altcoins experienced a bounce as prices rose following sharp declines on Monday. Solana’s SOL gained 3.4%, Tron’s TRX was up 0.8%, and Cardano’s ADA added 2.3%.

What we’re reading

- A Tornado Cash alternative and another rage quit coloured an intense week in DeFi — DL News

- Regulate crypto globally, say G20 leaders — DL News

With reporting assistance from Tim Craig.

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.