- Bitcoin futures contracts are experiencing levels of open interest similar than during the last bull run.

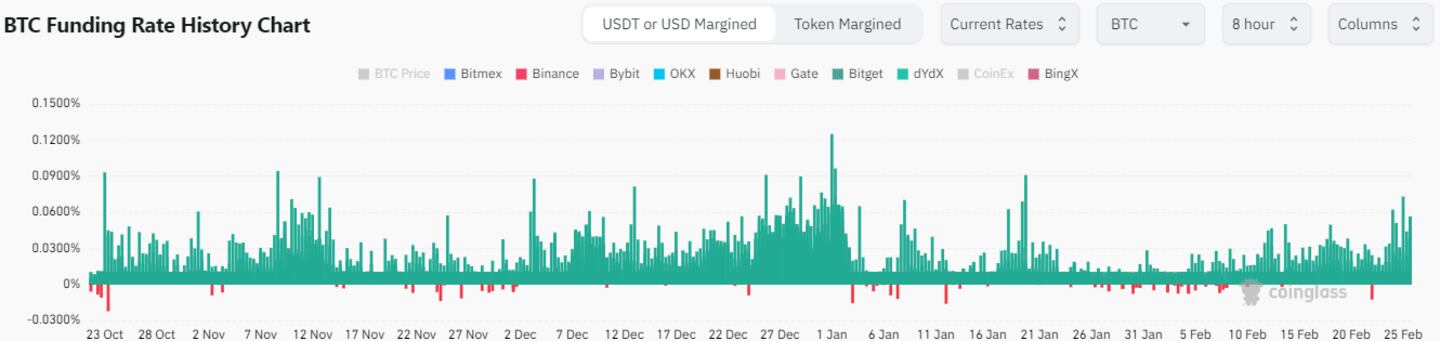

- Funding rates for perpetual futures contracts are at their highest point in a month.

Bitcoin’s derivatives market is flashing bullish signals.

Hovering at $52,000, the world’s largest cryptocurrency is up more than 19% this year, buoyed by relentless inflows into newly-launched Bitcoin spot exchange-traded funds.

Also helping: anticipation for the halving event expected in April.

Mounting open interest

Open interest for Bitcoin futures contracts across all exchanges sits at about $22 billion — levels unseen since the tail-end of the previous bull market, in November 2021, CoinGlass data shows.

Bitcoin futures contracts allow traders to buy or sell the asset at a predetermined price at a specified date.

Open interest reflects the total outstanding futures contracts held by market participants.

High open interest shows more traders are entering into contracts, reflecting heightened demand for the contract’s underlying asset.

“Open interest can serve as a valuable metric to assess short-term bullish sentiment,” Le Shi, head of trading at market maker Auros, told DL News.

Funding rates

At the same time, positive funding rates for so-called USD-margined perpetual contracts — which are similar to futures contracts but have no expiry date — are at their highest point in over a month.

Rates for perpetual contracts across major exchanges Binance, Bybit and BitMex, and others have spiked to levels unseen since January 21, Coinglass data shows.

Funding rates are periodic payments made by traders based on the difference between the perpetual contracts’ prices and the spot prices of the underlying asset.

A high funding rate often indicates that there is a significant demand for long positions in the market.

In other words, traders holding long positions are willing to pay a premium to maintain their positions, suggesting optimism regarding the future price of Bitcoin.

“As demand for exposure grows, funding rates tend to adjust accordingly, and this is particularly evident in the industry’s sensitivity to sentiment changes,” Shi said.

Crypto market movers

- Bitcoin is up 2.7% in the last 24 hours and trading for $52,866.

- Ethereum is up 3.2% in the same period, priced at $3,138.

What we’re reading

- Lido’s stETH leapfrogs XRP market value amid Ether staking frenzy — DL News

- MicroStrategy’s Official X Hacked: Over $440,000 In Crypto Stolen — Milk Road

- Satoshi’s Emails to a Bitcoin Co-Developer: The 5 Most Revealing Quotes — Unchained

- MicroStrategy Buys 3,000 Bitcoin (BTC) For $155 Million — Milk Road

- Stung by FUD, Hong Kong’s web3 dream is in jeopardy — DL News

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.