- Traders are changing how they bet on Bitcoin's rise and manage risk.

- Traders are becoming less risky with their bets, which will underpin big gains, says Decentral Park.

Bitcoin is trading at its highest level since late 2021 and its latest move is more stable than recent rallies, according to Kelly Ye, head of research at Decentral Park Capital, a crypto investment firm.

The data “indicates the rally is less driven by speculative leverage from long positions,” Ye said.

In other words, wild, speculative bets are no longer the norm, and it’s a sign that Bitcoin has room to run, Ye said in a report.

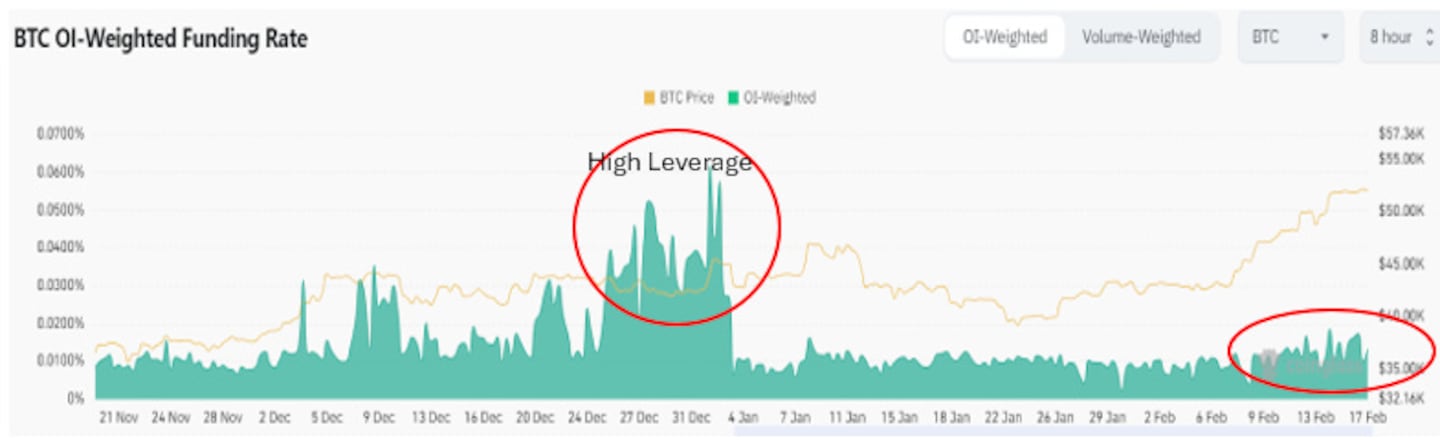

Ye points to data on Bitcoin perpetual futures contracts, or perps — a popular derivative contract predominantly used in crypto that have no settlement date.

“Unlike the year-end rally in 2023, which was mostly driven by speculative bets on the spot ETF approval, the funding rate for BTC perps is still at a healthy level,” Ye said.

Since these contracts trade in perpetuity traders have more flexibility to continuously place leveraged bets.

Funding rates

These bets are managed through so-called funding rates.

In essence, funding rates involve traders holding long positions and paying those with short positions, or vice versa.

If the rate is positive, traders with long positions pay shorts to maintain their positions, and vice versa.

A high positive funding rate suggests traders are taking on too much leverage, or placing risky bets, on the price of Bitcoin rising.

Right now rates are positive, but still quite low, suggesting traders are showing more restraint than during previous rallies.

Funding rates soared at the beginning of January when leverage was high, with rates around 0.06%. But things have cooled down since then as Bitcoin’s price continues to soar.

The high funding rates at the end of December contributed to Bitcoin’s price plunging over 5% after reaching a 21-month high ahead of spot Bitcoin ETF approval.

The market was “overstretched,” Noelle Acheson, author of the Crypto is Macro Now newsletter and former head of research at Genesis, told DL News at the time.

Traders aren’t shying away from perps though, in fact the market is seeing even more volume than during December’s rally.

Open interest in Bitcoin perpetual futures reached a two-month high above $12 billion in mid-February.

New rules

What’s driving the recent price action if traders are showing more caution?

Decentral Park attributes the latest move to the success of Bitcoin ETFs and new rules in the US.

Money is piling into US-based Bitcoin ETFs, as the newly launched products attracted a record $2.45 billion of inflows the week of February 12.

So far, over $10 billion have flowed into these products, excluding Grayscale’s Bitcoin ETF.

‘The $14.4 billion inflow within one year is already a conservative estimation.’

— Kelly Ye, Decentral Park Capital

Around $5 billion of that is net inflows, and the soaring demand has prompted analysts to change their predictions.

More will come as providers like BlackRock and Fidelity ramp up their marketing efforts, according to Ye.

“The $14.4 billion inflow within one year is already a conservative estimation,” Ye said, referring to Galaxy Digital’s inflows forecast made prior to launch.

Decentral Park anticipates “larger inflows from [registered investment advisers] and wealth management platforms once the gatekeepers have completed their due diligence.”

In addition to demand for Bitcoin ETFs, more US-based corporations may follow MicroStrategy’s lead and invest in Bitcoin as a strategic asset, Ye said.

The Financial Accounting Standards Board changed US accounting rules in December 2023, which means firms can “hold crypto assets at fair value, allowing them [to] recognise gains rather than just impairment loss,” Ye said.

Crypto market movers

- Bitcoin fell 0.4% to $52,400 on Tuesday.

- Ethereum rose 2.7% on Tuesday, to trade just below $3,000.

What we’re reading

- A trader just made $13m selling an early Ethereum NFT collection — DL News

- Anthony Scaramucci: Here’s the real reason behind Gary Gensler’s ‘I hate crypto’ stance — DL News

- Crypto Funds Witness $2,450,000,000 Inflows; U.S Leads Charge — Milk Road

- Revolut Building Dedicated Crypto Exchange For Advanced Traders — Milk Road

- 3AC and FTX Creditors Gain on Worldcoin’s WLD Surge — Unchained

Adam Morgan MacCarthy and Sebastian Sinclair are both market correspondents at DL News. Got a tip? Email them at adam@dlnews.com and sebastian@dlnews.com.