- BlackRock and Fidelity have emerged as clear winners within the first days of Bitcoin ETF trading.

- Grayscale Bitcoin Trust saw the largest daily volumes, but was plagued by $580 million in outflows.

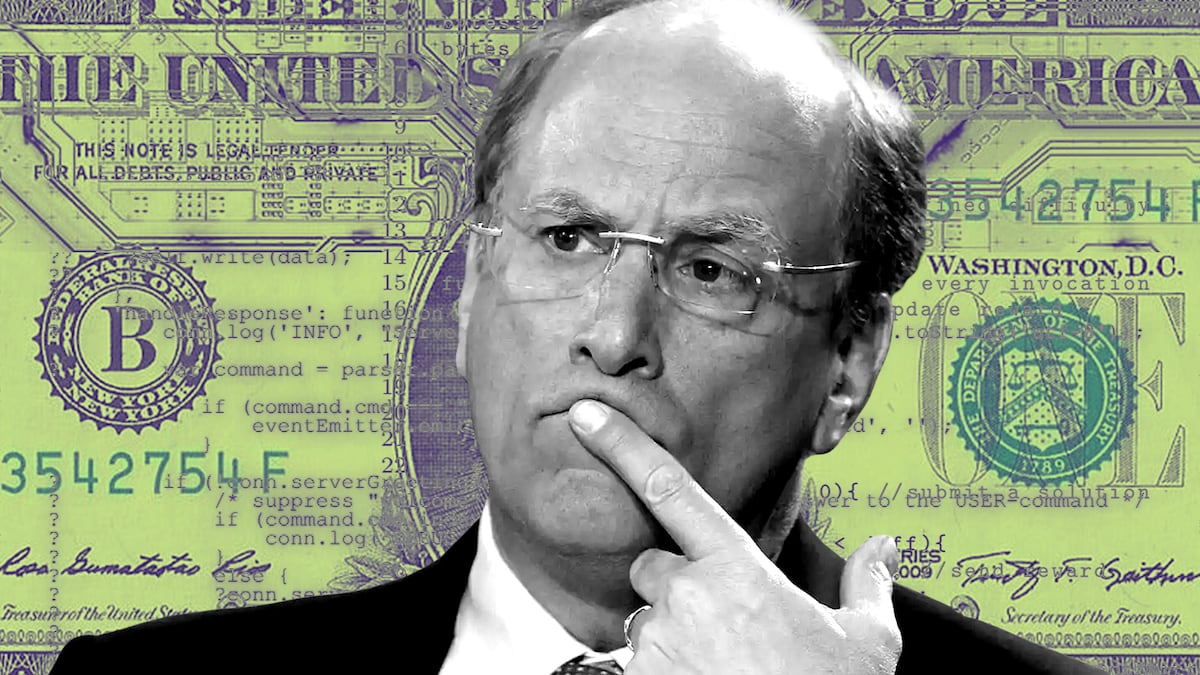

Investment powerhouses BlackRock and Fidelity have emerged as the two frontrunners in the spot Bitcoin exchange-traded fund race just days after US regulator approval.

That’s according to new research from investment advisory firm Bernstein, which calculated that the funds generated about $11 billion in trading volume and approximately $800 million in inflows in the first two days of trading,

“So far, it seems a two-horse race” between Fidelity and BlackRock to be the market leader, analysts led by Gautam Chhugani at Bernstein said.

BlackRock and Fidelity garnered $498 million and $422 million respectively in total flows over the first two days of trading, following the US Securities and Exchange Commission greenlight for 11 spot Bitcoin ETFs last week.

However, Bitwise and Ark were not far behind, securing $238 million and $105 million respectively over the same period.

Charts included in the Bernstein report listed ProShares as one of the spot Bitcoin ETFs, despite it being a futures Bitcoin ETF.

Without ProShares, the listed volume over the first two days was more like $7.9 billion — closer to the $7.8 billion estimated by Bloomberg Intelligence analyst Eric Balchunas.

GBTC discount

Bernstein suggested the disparity between the $800 million inflows and the substantial $11 billion trading volume could be attributed to market makers capitalising on liquidity in leading funds — and potentially arbitraging between GBTC discounts and premiums on other ETFs.

While GBTC leads in trading volumes at $4.3 billion, the firm experienced net outflows of $580 million.

Final volumes on the first two days have yet to come out as settlement times can add to a lag in data.

“We would expect the GBTC redemptions towards other ETFs to continue, while new inflows to ETFs would stabilise more gradually,” Bernstein wrote.

Grayscale’s flagship product has historically tracked the price of the Bitcoin, but didn’t offer users the option to redeem shares over the past few years.

As a result, there was a disparity — or a discount — between its share price and the spot price of Bitcoin.

Since GBTC has converted to an ETF this disparity is expected to shrink.

The GBTC discount stood at 1.17% while the other ETFs traded at premiums ranging between 0.13% to 0.5% during the first two days of Bitcoin ETF trading — enabling market makers to profit from the price difference.

Bernstein forecasts Bitcoin may experience temporary weakness, potentially finding a local bottom in the $38,000 to $42,000 range.

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.