Happy Sunday!

Coinbase responds to a letter from Senator Elizabeth Warren accusing it of undermining attempts to regulate crypto. Political spending by the US crypto industry increases, and Bitfinex researchers have a positive outlook for 2024. Read on!

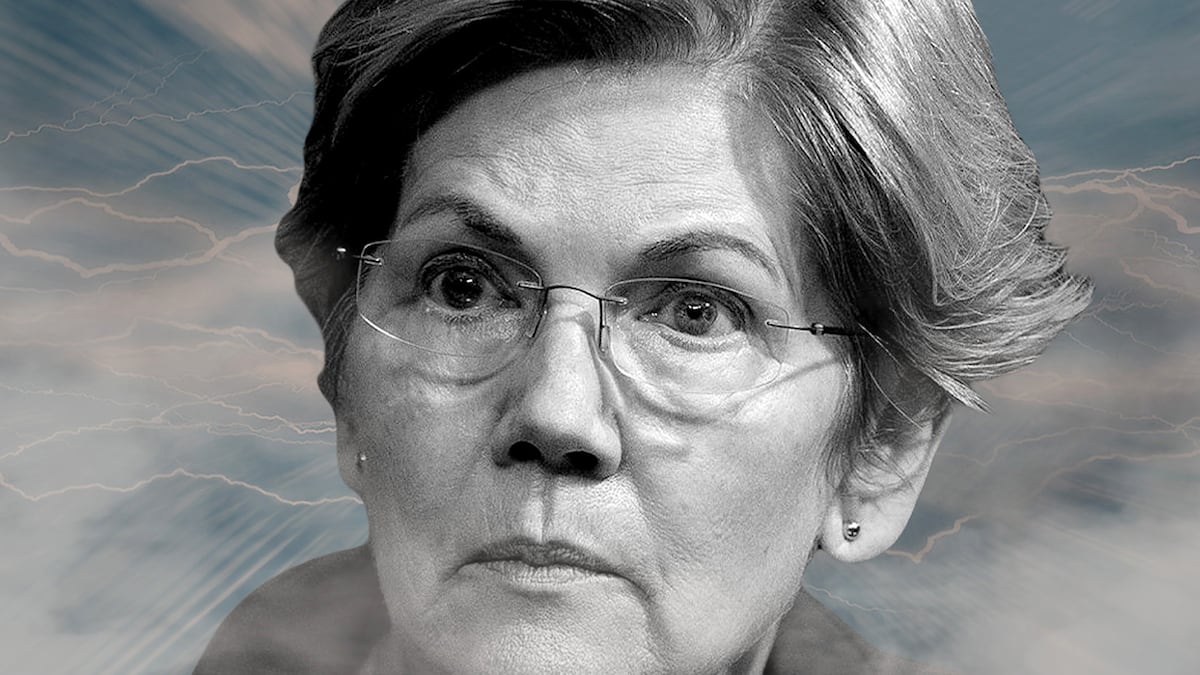

Coinbase disputes Warren crypto accusations

Coinbase publicly rebutted a December 18 letter from Senator Elizabeth Warren suggesting the company was hiring “former defense, national security and law enforcement officials” to undermine bipartisan congressional efforts to properly regulate crypto at a time when it is being used for unlawful purposes that include terrorist financing.

Faryar Shirzad, chief policy officer at Coinbase, said in a post on X that the company was proud of its “record of rooting out illicit activity on our platform, and of our deep partnership with law enforcement in going after bad guys.”

He added that the success of Coinbase “stems from hiring national security and law enforcement veterans who help us do everything we can to protect the American people.” Shirzad also posted a copy of the letter he had sent to the senator in reply and invited the Massachusetts Democrat to a briefing on the company’s efforts to combat terrorist financing.

Crypto industry hikes US political spending

Crypto companies have increased US political spending as Washington’s mood has darkened following the high-profile troubles of FTX and Binance, increased scrutiny by the Securities and Exchange Commission, and calls from Senator Elizabeth Warren and others to crack down on unlawful crypto activities, the Financial Times reported.

Coinbase, Circle and a16z were among firms helping build a $78 million warchest for Fairshake, a super Pac that plans to spend on electing pro-crypto legislators and moving bills through Congress as the 2024 presidential election approaches, the report said.

Politico recently reported that Coinbase had started a grassroots advocacy campaign, and that other pro-crypto super PACs were likely to organise.

Bitfinex researchers positive on 2024 outlook

Bitfinex researchers have a positive outlook for Bitcoin and other crypto assets in 2024, as a new report sees total capitalisation of the crypto market potentially doubling to $3.2 trillion.

Bitcoin mining activity will be important in 2024 as it is a halving year, and miners will have to run their operations efficiently. The report also noted that in El Salvador, which made Bitcoin legal tender in 2022, its adoption continues to gradually increase.

Yellow Card to seek Nigeria licence

Pan-African exchange Yellow Card Financial plans to apply for a licence to operate in Nigeria after its central bank relaxed a 2021 ban on crypto to adopt a regulated approach, Bloomberg reported.

“You’ve waited for something and it has come true and we’ll jump on it immediately,” Ogochukwu Umeokafor, director of product management at Yellow Card, told Bloomberg in a phone interview. “We want a regulated environment because it’ll help the business move; it will help people have more confidence in doing business with us.”

Crypto professor joins Turkey central bank panel

Fatma Ozkul, a professor and author at Marmara University who specialises in accounting, crypto assets and blockchain technology, was appointed to Turkey’s central bank rate-setting committee by President Recep Tayyip Erdogan, Bloomberg reported.

Ozkul has written many academic papers and a book on crypto asset accounting, according to her university profile.

What we’re reading around the web

Curve DAO agrees to $44m compensation for July hack victims — DL News

BitMEX founder has a warning about spot ETF approval — Crypto.News