- Institutional participation in CME Ethereum futures contracts picked up last week.

- Coinbase institutional research linked the increased activity to reports that an Ethereum futures ETF will soon get approved.

- Bitcoin and Ethereum continue to trade in the same tight range as last week.

Happy Tuesday!

Crypto markets continue to trade in a tight range after showing modest signs of recovery last week. Ethereum futures activity on the CME picked up after reports that a futures exchange-traded fund could soon be approved, according to Coinbase’s head of institutional research, David Duong.

Let’s dig in.

Ethereum perks up

Institutional investors warmed on Ethereum futures contracts on the CME last week, according to David Duong, head of institutional research at Coinbase.

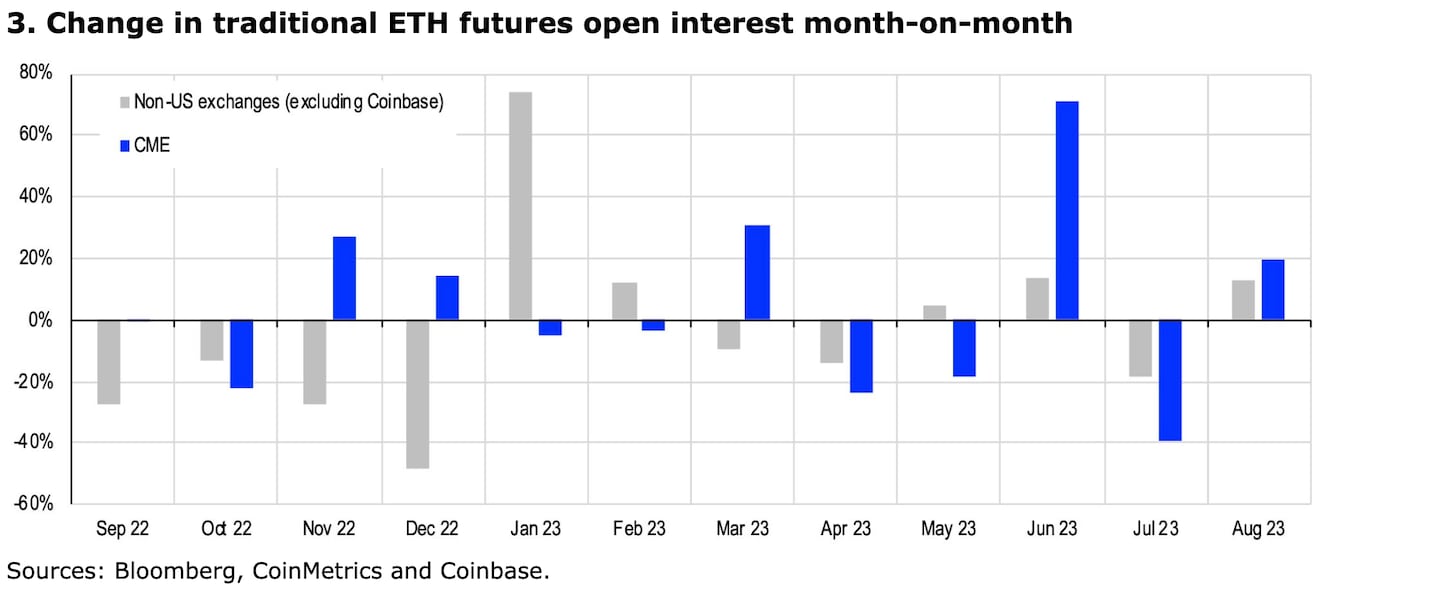

Open interest on the CME’s Ethereum futures increased about 11% between August 17 and 23 to a notional value of $348 million.

Open interest represents the total number of outstanding futures contracts held by market participants at the end of the trading day, according to the CME Group. “It is used as an indicator to determine market sentiment and the strength behind price trends,” the exchange’s website notes.

Exchanges outside of the US saw the number of outstanding contracts decline by 2.5% in the same period.

The moves followed reports on August 17 that the US Securities and Exchange Commission is likely to approve an Ethereum futures ETF by October.

Since the beginning of August, open interest in CME’s Ethereum futures increased 20%, but this follows a 39% decline in July — when many traders unwound positions following a spike in activity in June, Duong noted.

The flow observed last week may be warranted, Duong said, adding that “approval of an Ethereum futures ETF could yet be meaningful.”

Duong likened the potential approval to when ProShares launched the first Bitcoin futures ETF in October 2021. The asset manager accumulated $1.2 billion in assets in its first week of trading, according to Duong’s report.

“On the other hand, Ethereum fundamentals have been affected by the decline in the total value locked of the decentralised finance (DeFi) complex to $38 billion (based on data from DeFiLlama) following the Curve exploit earlier this month and more recently, a critical vulnerability on Balancer,” Duong concluded.

Crypto market movers

- Bitcoin traded down 0.1% to around $25,900 over the past day, down 0.6% over the last seven days.

- Ethereum added 0.2% to trade at $1,640.

- Altcoins continue to experience larger price movements. Tron’s TRX slid 1.3%, Solana’s SOL slipped 0.8%, and Polkadot’s DOT added 2.1%.