- Bitcoin and Ethereum both traded down after showing initial signs of recovery on Thursday.

- Fed Chair Jerome Powell’s Friday speech could move markets as interest rates take centre stage.

- Altcoins led the drop, with Solana’s SOL shedding all of its gains from Thursday.

Happy Friday!

Crypto prices contracted as market participants reassessed interest rate expectations. During the Fed’s economic symposium in Jackson Hole, Wyoming this week, senior officials have dropped signals that rates may rise before the end of the year.

Let’s dig in.

Market dip

Investors appear skittish ahead of US Federal Reserve Chair Jerome Powell’s speech from Wyoming today.

The central bank may need to make “additional increments,” to interest rates, Boston Fed president Susan Collins said on Thursday, before adding that “we may be very near a place where we can hold for a substantial amount of time.”

In a separate conversation on Thursday, Philadelphia Fed President Patrick Harker said “We’ve probably done enough,” in relation to potential interest rate hikes. Harker called for rates to be kept at their current level, a more doveish approach than his colleague Collins.

Collins isn’t a voting member on the Federal Open Market Committee, the central bank’s policy-setting body, this year, but Harker is.

While a lot can be gleaned from the various Fed presidents’ conversations in Wyoming this week, the most important speech comes later today.

Jerome Powell is set to speak at 3 pm London time. Any signs of hawkish intent are sure to send crypto markets lower as rate hikes negatively impact risk assets — such as crypto.

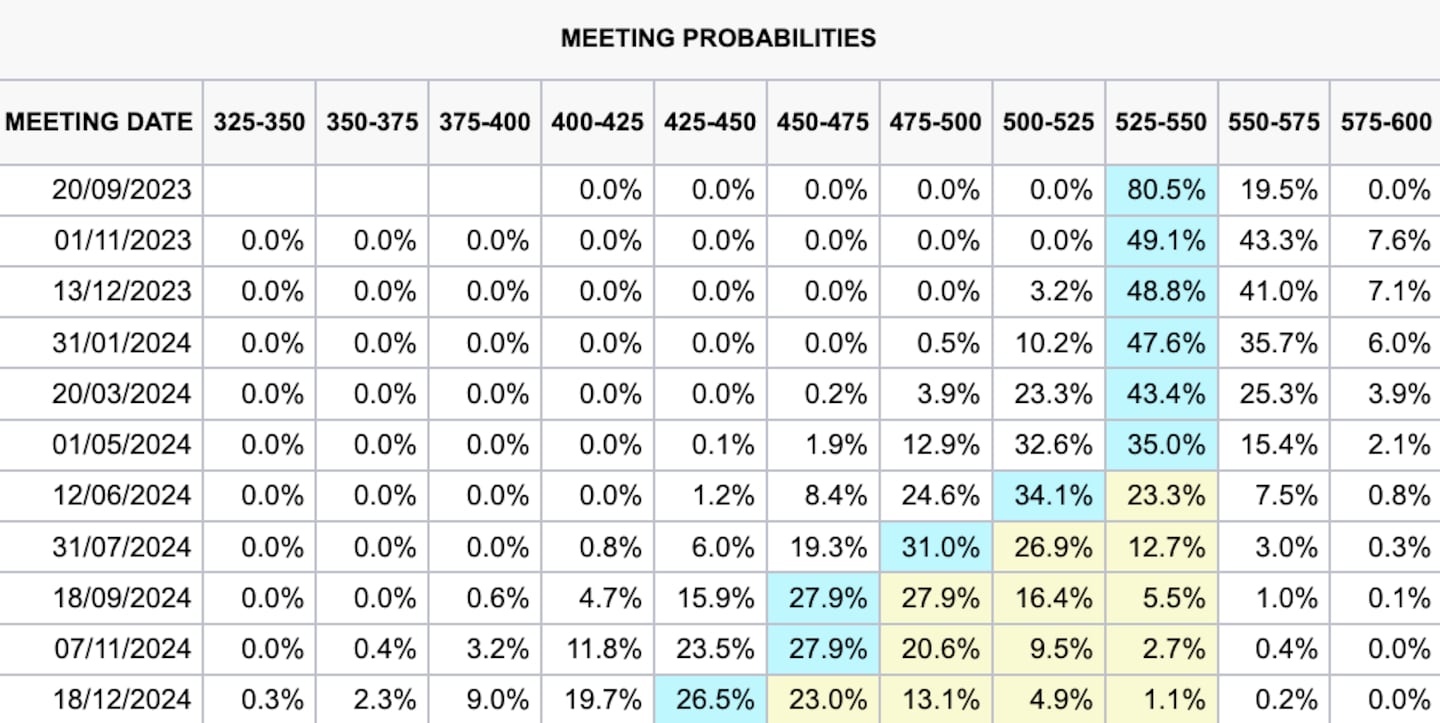

The central bank’s next interest rate decision is set for September 20. Markets are pricing in an 80.5% probability of a pause at the next meeting, but the likelihood of an increase before the end of 2023 is nearing 50%, according to the CME’s FedWatch tool.

Markets whipsawed throughout the week as investors weighed up the mood in Wyoming.

Trading volumes remain muted with liquidity low. Prices are prone to exaccerbated swings during periods of low liquidity, Kaiko said earlier this week.

Crypto market movers

- Bitcoin slid 1.5% to trade around $26,000 again. Increased volatility over the past week following all-time lows at the beginning of August. Volatility typically increases after long periods of calm in the market.

- Ethereum dropped 1.1% to trade around $1,650.

- Altcoins had sharper losses overnight. Solana’s SOL wiped out all of the previous day’s gains, dropping 5%. Binance-affiliated BNB was down 1.7%, as was Cardano’s ADA.

What we’re reading

- Wintermute CEO says pump-and-dump accusations are ‘flattering,’ talks Yearn Finance proposal – DL News

- The Roundup: Crypto’s correlation to equities jumps as markets dip – DL News