- Grayscale could hear back from the DC Circuit court on its case against the SEC this week.

- Bitcoin and Ethereum funds experienced outflows last week as markets dipped.

Happy Tuesday!

Experts expect an imminent decision in Grayscale’s case against the Securities and Exchange Commission. News in its case could drop today at 4 pm London time, or on Friday at the same time.

Let’s get to it!

Grayscale vs. SEC

Asset manager Grayscale is still hopeful it can convert its Grayscale Bitcoin Trust into a spot Bitcoin exchange-traded fund, despite several rejections.

The firm brought its case to the DC Circuit earlier this year and CEO Michael Sonnenshein was left “encouraged” by how oral arguments went. Now a decision looms.

Last week analysts at Bloomberg Intelligence and a lawyer at Davis Polk said Grayscale could expect a ruling in its case with the SEC soon.

Similar cases are typically settled about 160 days after oral arguments, Scott Johnsson, an associate at Davis Polk said. Grayscale’s case was heard on March 7, nearly 170 days ago.

What’s more, judges typically like to clear their caseload before a new batch of law clerks cycle in. The next rotation begins next month.

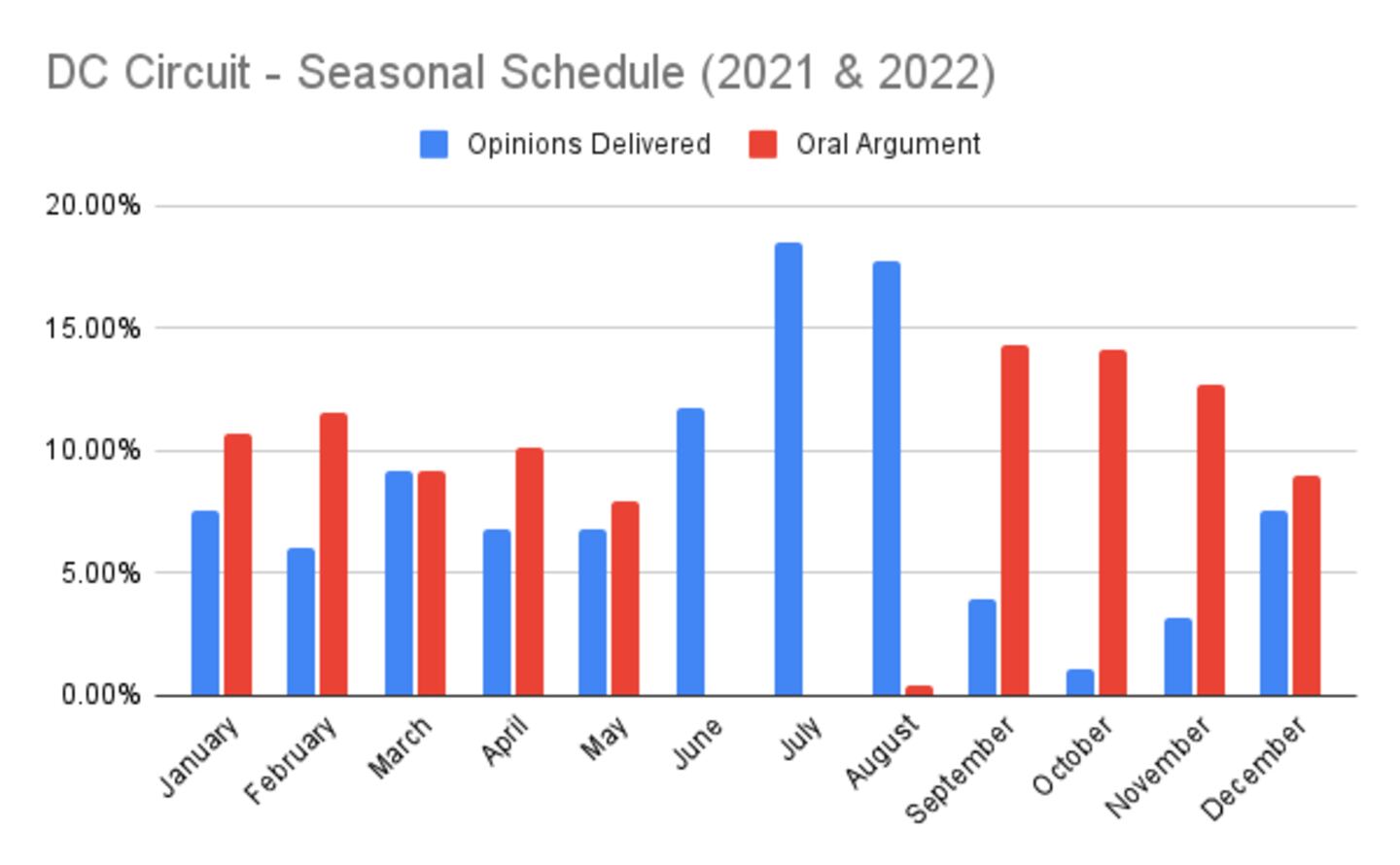

Less than 5% of opinions are delivered in September, according to a graphic shared by Johnsson. Most opinions drop in July and August.

Based on these estimates from Johnsson, and supporting comments from Bloomberg Intelligence’s James Seyffart, we could have a decision on GBTC’s conversion to a spot Bitcoin ETF imminently.

GBTC’s discount to net asset value had narrowed to 23% from over 40% over the summer, this has widened slightly to around 27% now, according to Coinglass data.

Shares in the trust aren’t exchangeable for Bitcoin, so there’s a disparity between the price of shares and the underlying asset. Basically, if you could exchange your GBTC shares for Bitcoin, then they’d be worth about 27% less than the market value of Bitcoin.

Crypto market movers

- Bitcoin traded around $26,000 on Tuesday, flat over the past 24 hours. Digital asset investment products holding Bitcoin saw outflows of $42 million last week, according to CoinShares’ data. This was a reversal of the previous week’s inflows.

- Ethereum continues to trade around $1,660. Fund flows for the second-largest digital asset by market capitalisation saw $9 million in outflows last week.

What we’re reading

- Wall Street’s Bitcoin land grab may push crypto firms ‘by the wayside,’ say finance veterans – DL News

- The Decentralised: Aave’s $0.97 stablecoin and Unibot ups its security – DL News

Adam Morgan McCarthy is a London-based markets correspondent for DL News. To contact him with story tips, reach out at adam@dlnews.com.