- Do Kwon gets out.

- Corporate Bitcoin whales surface.

- Old Bitcoin miners get new lease on life.

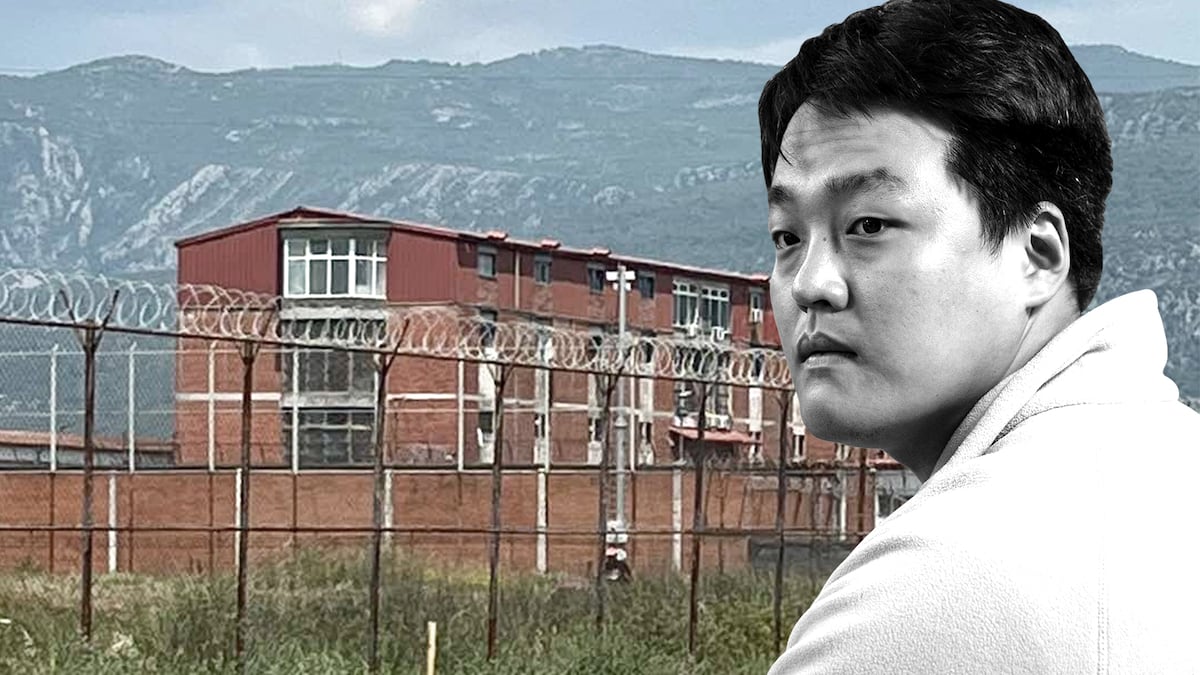

Do Kwon released from Montenegro prison

Do Kwon was released from prison in Montenegro on Saturday as the Supreme Court considered extradition requests from the US and South Korea, Bloomberg reported.

On Friday, the Supreme Court suspended a lower court decision to extradite the Terraform Labs co-founder to his native South Korea.

Kwon faces fraud charges in South Korea and the US related to the Terra Luna collapse, which wiped out about $60 billion of market value in 2022, DL News has reported.

“We released Do Kwon from prison as his regular prison term for travelling with fake papers ended,” prison director Darko Vukcevic told Bloomberg. “Since he is a foreign citizen and his documents were withheld, he was taken for an interview to the police directorate for foreigners, and they will deal with him further.”

Kwon’s lawyer, Goran Rodic, confirmed his release, the report said. State TV said Kwon was moved to a shelter for foreigners later on Saturday, and also confirmed that his passport was being held by the authorities.

A year ago, Kwon was apprehended on the tarmac of Podgorica Airport in Montenegro in a private jet, attempting to travel to Dubai on a forged Costa Rican passport, DL News reported at the time.

He was later found guilty of attempting to travel with falsified documents and jailed. Since then he has challenged attempts to extradite him for trial.

Potential extradition to the US or South Korea is now in the hands of Montenegro’s Supreme Court, which gave no time-frame for a decision, according to Bloomberg.

Corporate Bitcoin whales surface

MicroStrategy is by far the biggest corporate holder of Bitcoin, with 174,530 valued at about $9.1 billion as of February 22, OilPrice.com reported, citing data from CoinGeko.

It was followed by public companies Galaxy Digital with 17,518 Bitcoin valued at $912 million, and Marathon Digital with 13,716 valued at $714 million.

Bitcoin holdings have helped the mostly US companies’ share prices rise, the report said, especially MicroStrategy, whose stock soared more than 350% in 2023.

Completing the top five were Tesla, with 10,500 Bitcoin valued at $546.7 million, and Canada’s Hut8, with 9,366 valued at $487.6 million.

Halving sends old Bitcoin mining equipment abroad

Spurred on by April’s anticipated halving event, about 600,000 outdated S19 series computers are being shipped out of the US, Bloomberg reported, citing an estimate by Ethan Vera, chief operating officer at crypto-mining services and logistics provider Luxor Technology in Seattle.

SunnySide Digital Chief Executive Officer Taras Kulyk, who has sold older, refurbished US computers to miners in countries including Ethiopia, Tanzania, Paraguay, and Uruguay, said the reselling process “is accelerated by the halving.” He added that it is a “natural migration,” because the older machines will be operating where power is cheaper.

Big US miners are upgrading to more efficient technology to deal with higher electricity costs and to counter the impact of the halving on their revenue streams, the report said.

Bitcoin’s next halving, an automated process, will cut the number of coins provided as a reward to miners by half, to 3.125, DL News has reported.

Crypto market movers

- Bitcoin is up 1.23% today at $64,783.00.

- Ethereum is up 0.63% today at $3,351.03.