- No fewer than six Ether Futures ETF applications were made this week, with little impact on the price of Ethereum.

- Analysts expect the products to be accepted as early as October.

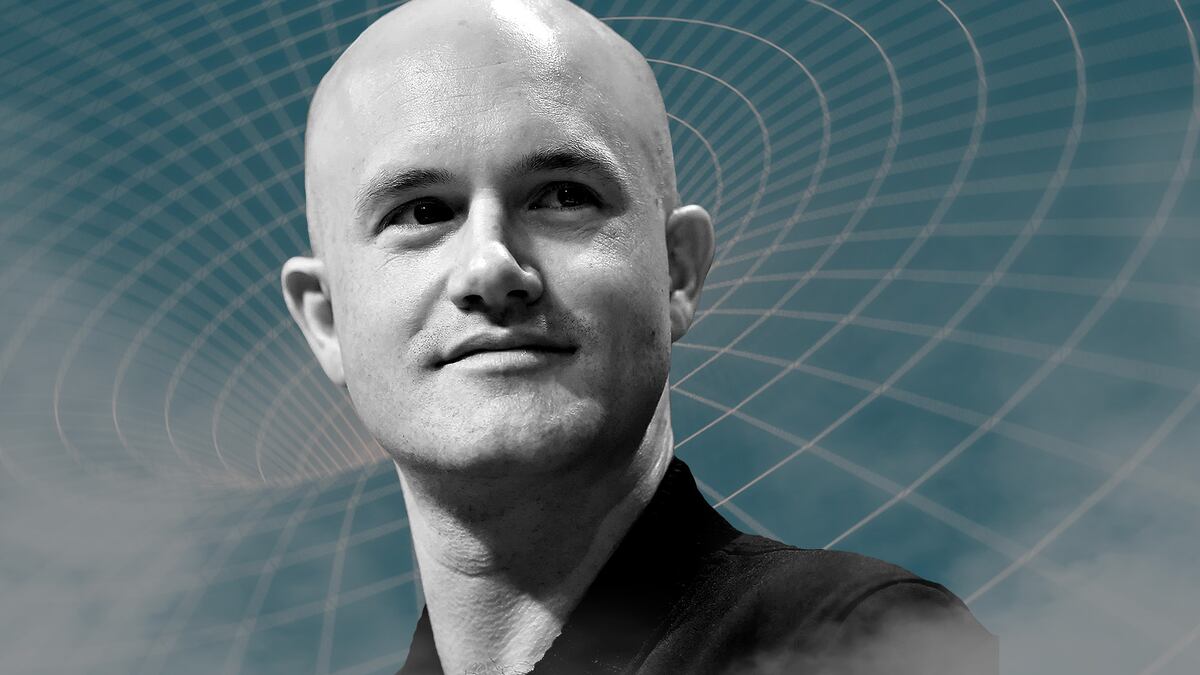

- Coinbase and Block CEOs have public spat on Twitter.

Happy Thursday!

In today’s markets snapshot, we look at how a raft of applications for Ethereum exchange-traded funds failed to lift investor sentiment. Elsewhere, we set the stage for Coinbase and Block’s earning calls after the two firms’ CEOs clashed in a public Twitter spat.

Check it out.

Ether Futures ETFs do little to entice investors

Volatility Shares kicked off the latest round of Ether Futures ETF applications last Friday.

Since then six other issuers have joined the race, including VanEck, Bitwise, and ProShares. Grayscale refilled its application on Tuesday, after previously withdrawing its filing in May.

Ethereum traded down 2.2% to $1,830, over the past week, according to CoinGecko data, despite the flurry of headlines.

The Securities and Exchange Commission has already approved ETFs holding CME-traded Bitcoin futures. This creates a “dilemma” for the agency, Nate Geraci, president of The ETF Store, told DL News.

The regulator has spent “considerable time and resources,” defending its rationale for approving the Bitcoin Futures ETFs, Geraci said.

“If the SEC is that comfortable with CME-traded Bitcoin futures ETFs, then it would only seem logical they should also be comfortable with CME-traded ether futures ETFs,” he added.

Another factor to consider is Volatility Shares involvement, according to Bloomberg Intelligence analyst James Seyffart.

“Key aspect here is that they are the same firm that managed to get a 2X leverage Bitcoin Futures ETF approved,” he said.

Overnight ProShares and Direxion filed applications for Bitcoin and Ether Strategy ETFs.

Earnings call

Coinbase and Block are set to deliver earnings after the close in New York today. The firm’s founders duked it out on Twitter yesterday.

Trading volumes on the exchange will be of interest to investors and analysts on Thursday afternoon. Volumes have reached multi-year lows as retail investors have been slow to return to the market following the market tumult in 2022.

Bitcoin sales through Block’s CashApp have risen steadily over the past three quarters. It registered over $2.1 billion in the first quarter, according to its shareholder letter.

Jack Dorsey, the co-founder of Twitter and Block, questioned Coinbase’s Brain Armstrong for, in his opinion, not promoting Bitcoin’s lightning network enough.

“Why do you continue to ignore Bitcoin and lightning?” Dorsey said, before adding, “What “crypto” is a better money transmission protocol and why?”

Armstrong replied on Twitter, saying that Coinbase is “looking into how to best add lightning.”

“It’s non-trivial, but I think worth doing. I’m all for payments taking off in Bitcoin,” the Coinbase CEO said.

“Not sure why you think we’re ignoring Bitcoin — we’ve onboarded more people to Bitcoin than probably any company in the world.”

Do you have a tip on markets? Let me know at adam@dlnews.com.