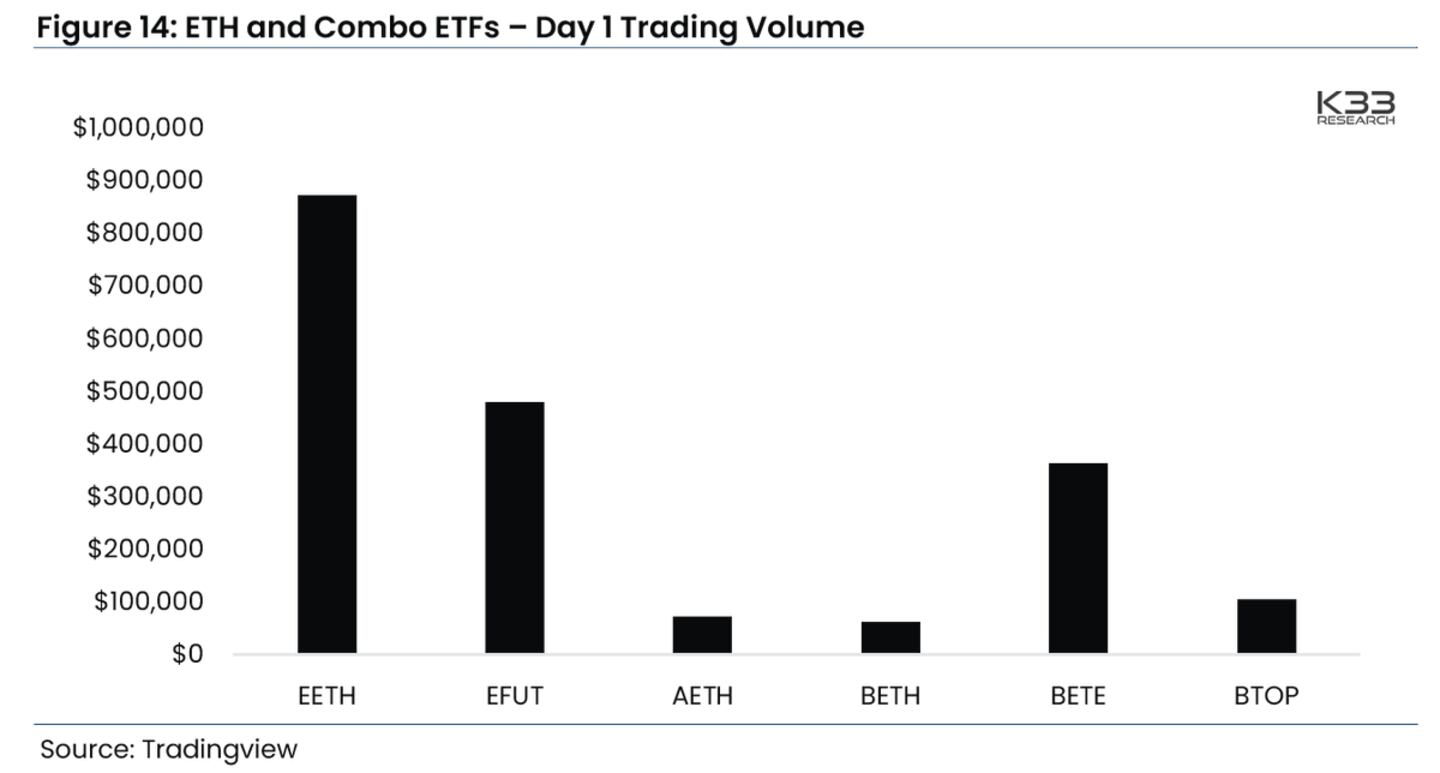

- New Ethereum futures ETFs attracted less than $2 million in trading volume on day one.

- Half VanEck’s Ethereum ETF’s trading volume came in the very first minute after its launch.

- The volumes pale in comparison to the Bitcoin futures launch. ProShares’s BITO did $200 million inside 15 minutes on its launch.

Happy Tuesday!

Six Ethereum futures exchange-traded funds got off to a slow start after launching on Monday. The funds attracted just under $2 million in trading volume.

Let’s dig in.

ETF(lop)

Investors have yet to warm to Ethereum futures ETFs.

The launch of six Ethereum futures ETFs in the US on Monday was “disappointing,” said K33 Research’s Vetle Lund.

The “shallow flows depict a hollow market and a deficient demand for Ethereum exposure,” he added.

Futures ETFs trade on the future value of an asset whereas spot ETFs trade on the current value of an asset.

So far, no crypto spot ETFs have been approved by US regulators, but several big financial firms like BlackRock and Fidelity have applied to launch them.

ProShares’s EETH and VanEck’s EFUT were the most popular Ethereum-only funds, respectively registering around $850,000 and $500,000 in trading volume.

Nearly 50% of EFUT’s volumes occurred during its first minute of trading, Lund said.

In a similar fashion to Bitcoin futures ETFs, ProShares looks likely to lead the way when it comes to Ethereum.

While Monday’s launch mirrored Bitcoin’s 2021 debut in that sense, it was entirely different when it comes to volume.

Bitcoin futures ETFs clocked up over $1 billion in trading volume in just two days — ProShares’s BITO did $200 million in the first 15 minutes.

ProShares’s BITO, which broke records, launched at the height of the bull market in 2021 — a “more opportune environment,” as Lund put it.

Bitcoin is also just more popular among, especially among those with a casual interest in cryptocurrency, said Bloomberg Intelligence ETF analyst Eric Balachunas.

The slow interest in the futures ETFs could be a prelude to price action.

A futures ETF can result in synthetic trading activity without actually impacting spot supply, according to crypto market makers QCP Capital.

Basically, traders are buying futures contracts, speculating on the price at a future date, and don’t have to hold Ethereum — unlike buying a spot product which holds the underlying asset and therefore effects spot supply.

“We would even go further to say a futures-only ETF is arguably detrimental to spot price,” the QCP Capital said, adding that it “potentially directs demand away from the spot market into a synthetic market.”

Crypto market movers

- Bitcoin is back below $28,000 after it fell 2.3% in the last day. Volatility is expected to increase according to Coinbase and Bitfinex.

- Ethereum was unaffected by the ETF launches on Monday, it dropped 3.8% in line with the broader crypto market.

What we’re reading

- Here comes another airdrop for Ethereum layer 2 users — DL News

- What to expect on Day 1 of Sam Bankman-Fried’s trial: TRM Labs’ Ari Redbord — DL News

- Bitcoin options market flashing volatility warning, says Bitfinex — DL News

- Why Bitcoin and DeFi are still struggling to recover as SBF’s trial opens — DL News

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.