- Franklin Templeton expects Base to capture a large share of the Ethereum layer 2 market.

- Base is a major draw for memecoins and SocialFi projects.

- USDC is the major stablecoin on Base.

Only Arbitrum at $2.6 billion has a great amount of deposits than Base’s $1.6 billion among all Ethereum layer 2 networks, DefiLlama data shows, and in a note published Thursday, Franklin Templeton said it expects Base to “remain a leader.”

Base is an Ethereum layer 2 blockchain that was started by crypto exchange Coinbase.

Franklin Templeton, a $1.5 trillion asset manager, pointed to “strong support” from Coinbase as a major positive for Base.

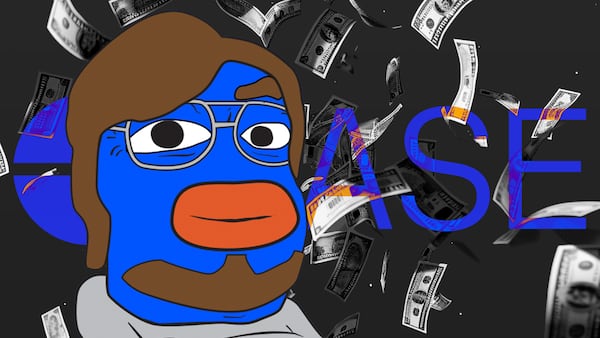

Base’s recent growth has been propelled by memecoin trading and interest in so-called SocialFi projects, Franklin Templeton said.

“In recent months, Base has seen a significant rise in activity, primarily driven by Base meme coins trading activity and SocialFi applications such as friend.tech,” the firm’s note stated.

Base’s buzzing activity levels have prompted an increase in transaction fees for Sequencer ― the part of Base’s network responsible for organising, verifying, and transferring transaction bundles to the Ethereum network.

Like other Ethereum layer 2 networks, Base hasn’t “decentralised” its Sequencer yet. All of its revenue now goes to Coinbase, the entity responsible for running the Sequencer.

The bulk of the spike in activity on Base came in March when memecoin trading reached a fever pitch. Some popular tokens included TOSHI and BRETT, with BRETT reaching a peak of $800 million in market value.

The memecoin trading came in the aftermath of Ethereum’s Dencun upgrade that lowered transaction fees on layer 2 networks by as much as 98%.

Franklin Templeton’s report also said that “Base has hit a home run” in the SocialFi niche.

“Currently, Base has [about] 46% for all transactions related to SocialFi,” the report said. “This category is a key vertical for Base adoption and growth.”

Before memecoins exploded on Base this year, friend.tech, a popular SocialFi project, was the major draw in 2023 for activity on the network.

Base’s growing user adoption has also meant a big increase in stablecoin volume on the network. The market cap for stablecoins on Base has reached $2.8 billion, according to DefiLlama.

Circle’s USDC stablecoin accounts for the bulk of the volume. That’s not common in DeFi where Tether’s USDT is the dominant stablecoin on most blockchains.

Coinbase’s support for free USDC transfers to the Base chain via the exchange’s wallet since December 2023 is a likely reason for the stablecoin’s popularity on the network.

Crypto market movers

- Bitcoin is down 2.31% in the last 24 hours

- Ethereum has fallen below $3,000 again, down 3.1% today.

What we’re reading

- Bitcoin hacker who took $72m returns funds in exchange for $7.2m as ‘bounty’ — DL News.

- Binance Registers With India’s Financial Intelligence Unit — Milk Road.

- Why Spot Ether ETFs Will Likely Have to Wait Until After the Presidential Election to Be Approved — Unchained.

- Kraken Fires Back At SEC, Arguing Agency’s Case Lacks Proper Wording — Milk Road.

- Bitcoin miner Hive sees AI-hungry tech giants driving $100m revenue gain — DL News.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.