Merry Tuesday!

So much to get through today, starting with how FTX bankruptcy administrators eye an offshore reboot. There’s also more trouble on Coinbase’s Base platform where another exchange seems to have been exploited for hundreds of Ether.

Elsewhere, a judge allowed the Securities and Exchange Commission to go forward with its case against Terraform Labs, a decision that seemingly rejected a key distinction made in the recent Ripple ruling. We also look at the US taxman’s new staking rules, and how Curve’s founder may be about to run out of cash.

It’s just another day in decentralised finance. Let’s dig into it.

Debtors float FTX reboot proposal

Bankruptcy administrators for FTX have set plans in motion to reboot the crashed crypto exchange, according to a Monday filing.

The proposed resumption of activity would take place outside of the US, where certain claimants would pool their assets to launch an offshore exchange platform with FTX branding.

Founder and ousted CEO Sam Bankman-Fried faces a string of criminal charges for his role in the collapse of his crypto empire.

LeetSwap exploited on Coinbase’s Base

LeetSwap halted trading on Monday after detecting suspicious activity suggesting that some pool liquidity might have been compromised.

The decentralised exchange, which operates on Coinbase’s new layer two blockchain Base, made the announcement just before crypto analytics firm Peckshield said it had seen reports suggesting an exploit worth around 340 Ether, or about $630,000.

Base is reeling after another native coin, BALD, went to zero in an apparent rugpull

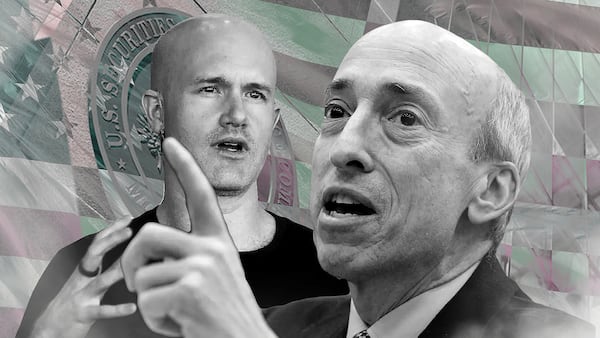

US judge at odds with Ripple decision

A US District Judge in the SEC’s case against Terraform Labs rejected a landmark decision made by another judge in the Ripple Labs case earlier this month.

Judge Jed Rakoff allowed the SEC to proceed with its claims that Terraform Labs and founder Do Kwon offered the sale of unregistered securities to retail investors — a claim that could have big consequences for the crypto space if confirmed.

IRS sets crypto staking guidelines

The US Internal Revenue Service set guidelines for tax calculations in regard to crypto staking on Monday, with both proof-of-stake earnings and staking via crypto exchanges addressed.

The IRS stated that taxes on staking reward earnings should be paid as soon as the staker gains possession of rewards.

Curve founder’s loans highlight DeFi risks

Following a Sunday exploit at Curve, founder Michael Egorov’s $168 million lending position is at risk of liquidation.

Egorov’s position on crypto lender Aave could have big implications for decentralised finance if liquidated, which has raised alarm bells among Aave’s governance community, among others.

What we’re reading from around the web

DeSantis accuses Biden of ‘war on Bitcoin,’ vows to stop it if elected president — CoinDesk

Bitcoin Ordinals break daily inscriptions record, but trading nosedives — The Block

Will Wall Street interest in Bitcoin scare cypherpunks away? — Decrypt