- Crypto ETFs may become a reality in Hong Kong as the city embraces digital currencies.

- Crypto founder Arthur Hayes explains how China is mirroring US efforts to launch a Bitcoin ETF.

Happy Monday!

Hong Kong is mulling crypto exchange-traded funds, Bloomberg reports.

Let’s dive into it.

Crypto ETFs in Hong Kong

Crypto spot ETFs open for retail investors may get the nod in Hong Kong, according to Bloomberg.

”We welcome proposals using innovative technology that boosts efficiency and customer experience,” Hong Kong Securities and Futures Commission Chief Executive Officer Julia Leung told the news outlet in an interview.

“We’re happy to give it a try as long as new risks are addressed,” she added. “Our approach is consistent regardless of the asset.”

The news comes as investors anticipate what may be imminent approval of Bitcoin spot ETFs in the US. Galaxy Digital CEO Mike Novogratz said in October that he expects such products will be launched before the end of the year.

ETFs offer investors an affordable and convenient way to bet on the performance of stocks, commodities, and cryptocurrencies. They also tend to be highly liquid.

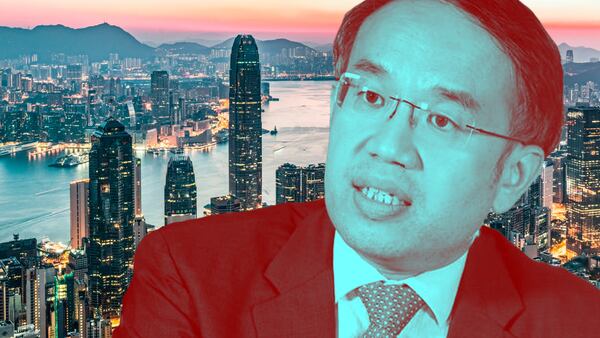

“Competition is amazing,” BitMEX co-founder Arthur Hayes wrote on X, quoting the Bloomberg report. “If the US has its proxy asset manager, BlackRock, launching an ETF, China needs its proxy asset manager to launch one too.”

“The US vs China economic war is great for BTC,” he added.

Hayes previously wrote that Hong Kong served as a “portal” to China, and that its financial system was allowed to be “freer and more experimental.”

Hong Kong recently pivoted back to crypto after cooling off on the industry to the point that in 2021 local crypto firms drew up contingency plans to leave the city.

Hong Kong also plans to release new guidelines for the tokenisation of securities and investment offerings, the Financial Services and the Treasury Bureau announced last week.

The agency’s secretary, Christopher Hui, said that the JPEX crypto exchange scandal, which has led to dozens of arrests in the Chinese territory, won’t derail Hong Kong’s plans to further embrace the crypto sector.

Finance executives are meeting in Hong Kong this week, as the de-facto central bank holds its second annual finance summit.

Crypto market movers

- Bitcoin is up 0.2% in the last 24 hours, reaching about $35,182

- Ethereum rose 0.3% in the same period, priced at $1,898.

- Ripple is up 11%.

What we’re reading

- Yuga Labs looks into complaints of eye injuries at ApeFest Hong Kong — DL News

- The UK is racing races to adopt stablecoin rules — here’s what they should look like — DL News

- Coin Center to appeal Tornado Cash loss vs US Treasury — here’s why it’s a long shot — DL News

Tom Carreras is a Markets Correspondent at DL News. Got a tip? Reach out at tcarreras@dlnews.com