- JPMorgan analysts outlined three key catalysts driving retail investors back to crypto.

- Bitcoin’s next halving and Ethereum’s Dencun upgrade are “largely priced in.”

- While approval of a spot Ether ETF is 50/50, the bank said this has attracted interest.

- The retail push into crypto was likely responsible for February’s rally, JPMorgan said.

Retail investors are flocking back to crypto in anticipation of three key catalysts in the coming months, according to JPMorgan analysts.

Catalysts

Retail interest rebounded in February after slowing in January, and it was “likely responsible for this month’s strong crypto market rally,” analysts at JPMorgan said in a note on Thursday.

JPMorgan analysts, led by Nikolaos Panigirtzoglou, showed a chart depicting total flows onchain for smaller versus larger wallets.

A smaller wallet is a proxy for a retail investor, they said.

They then adjusted for inflows into the newly launched spot Bitcoin ETFs, explaining: “Retail investors’ Bitcoin holdings that have shifted to the new spot Bitcoin ETFs are technically held in larger institutional wallets, even if the end-investor is retail.”

“After a pause in January, the crypto rally gathered pace in February,” they wrote.

The Bitcoin halving in April, Ethereum’s next major upgrade, and the prospect of spot Ether exchange-traded funds have lured investors back to crypto, the investment bank said.

The first two catalysts, the halving and Ethereum’s Dencun upgrade, are “largely priced in,” the analysts said.

JPMorgan analysts “only see a 50% chance,” of spot Ether ETFs gaining approval in May, meaning this catalyst isn’t fully priced in.

The halving

Bitcoin’s so-called halving, which occurs automatically once every four years, is expected in April. It marks a supply change, halving the amount of new Bitcoin created each day.

With less supply and growing demand for Bitcoin due to new investment vehicles, such as spot Bitcoin ETFs, analysts expect the halving to push prices higher.

The Dencun upgrade

Ethereum’s upgrade, dubbed Dencun, is scheduled March 13, and aims to enhance scalability and reduce transaction fees on layer 2 platforms.

Dencun is considered Ethereum’s most significant change since April 2023, when the so-called Shapella upgrade allowed stakers to withdraw staked Ether on the network.

Spot Ethereum ETF approval

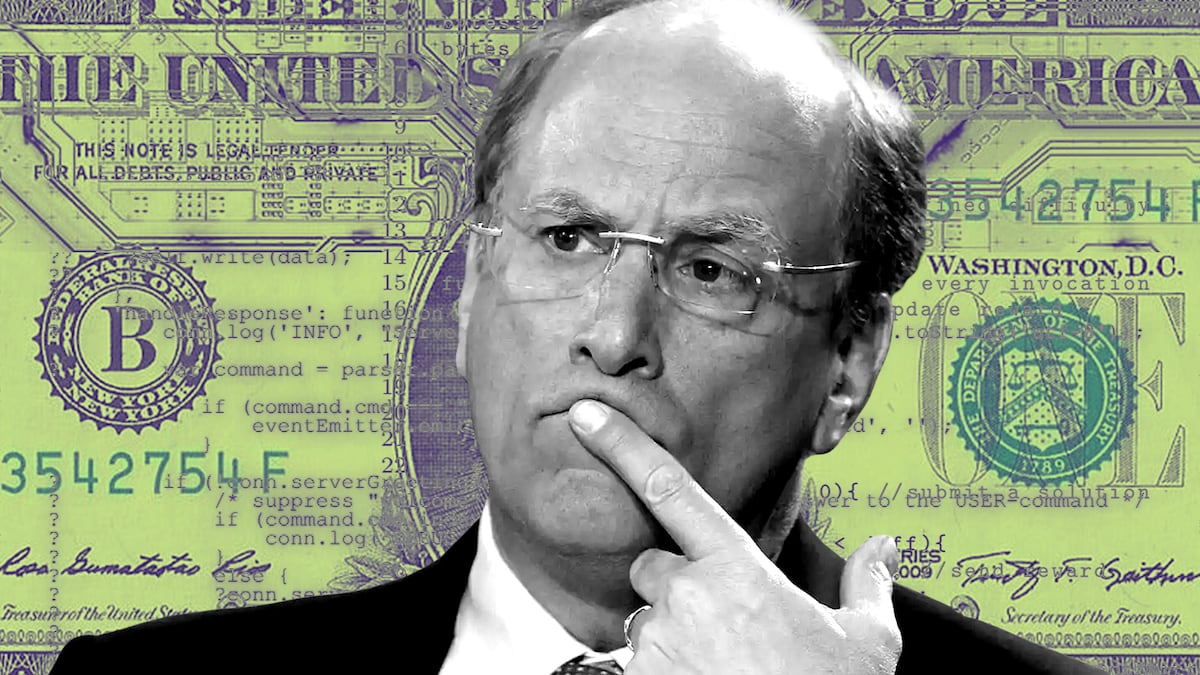

The potential US approval of spot Ethereum ETFs is the final catalyst JPMorgan cites.

After more than $10 billion poured into Bitcoin ETFs following their approval last month, Ethereum is also positioned to attract investors.

BlackRock is among fund giants hoping to win a green light for a spot Ethereum ETF, following its hugely popular entry into a Bitcoin version.

Some say Ethereum may even outperform Bitcoin if the ETFs win a regulatory nod, given that it’s more levered to economic activity in the crypto ecosystem.

Crypto market movers

- Bitcoin fell 0.6% to $51,200 on Friday. The leading cryptocurrency is down 2% over the past seven days.

- Ethereum traded just below $3,000, down 1.1% since Thursday.

What we’re reading

- Nigeria watchdog probes crypto market manipulation after currency crash — DL News

- South Korean leaders eye approval of Bitcoin ETFs as election heats up — DL News

- US Ethereum ETF Could Raise Concentration Risks: Report — Milk Road

- Worldcoin Skyrockets 300%: What’s Behind WLD Surge? — Milk Road