- Kamala Harris is signalling a break with the Biden Administration's crypto policy.

- Democratic presidential nominee's team has been taking soundings from Mark Cuban.

- Crypto industry is cautiously optimistic of a policy shift in Washington.

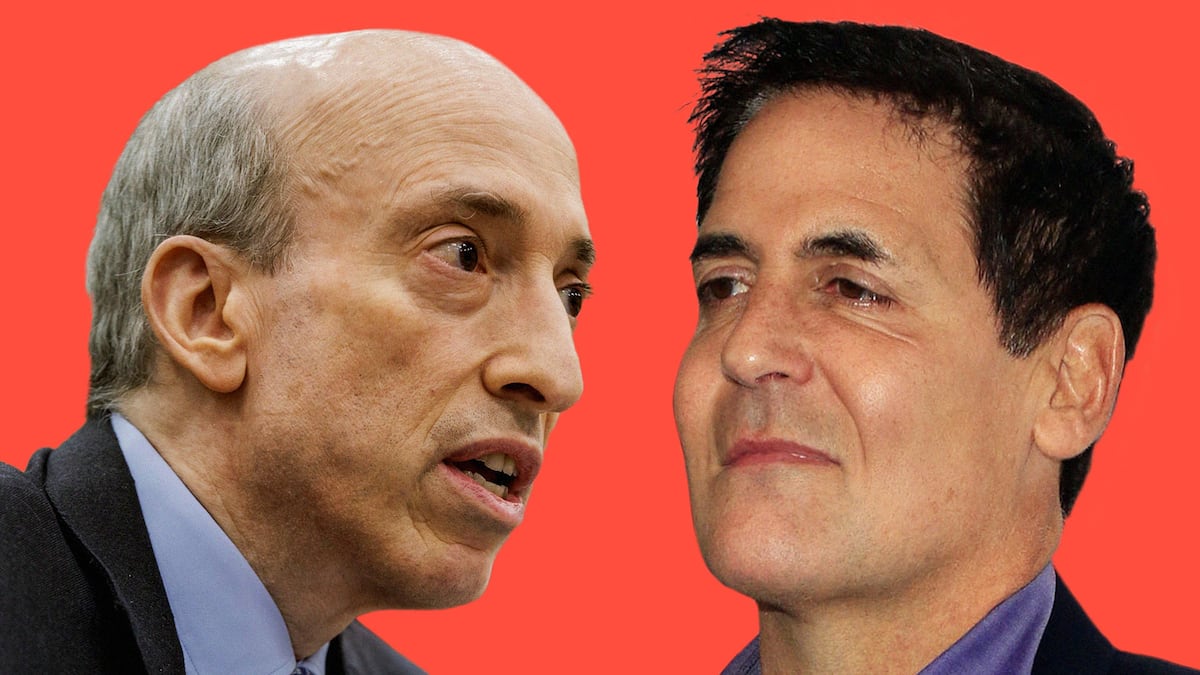

Gary Gensler, the chair of the US Securities and Exchange Commission, is having a bad week.

First, Representative Ritchie Torres, a Democrat from the Bronx in New York City, lambasted the former Goldman Sachs partner for arguing that NFTs, as well as other cryptocurrencies, are the same as stocks or bonds.

Then billionaire investor Mark Cuban floated that he was keen to replace Gensler even though he has two years left in his tenure as head of the top US finance regulator.

‘Head of the SEC’

In an interview on Fox News, Cuban said Wednesday he would be amenable to heading the SEC should Vice President Kamala Harris, the Democratic nominee for president, win in November.

“Head of the SEC, that’s the job I would take,” Cuban said.

Cuban has joined a chorus of crypto supporters calling for Gensler to go as his crackdown on the sector enters its fourth year.

The push to retire Gensler crosses party lines — Anthony Scaramucci and Cuban, both of whom are supporting Harris, echo the calls from crypto folk supporting her opponent, former President Donald Trump.

“You leaving is worth a point in GDP growth,” Cuban posted on X on Tuesday, referring to Gensler.

‘Gensler screws up again.’

— Mark Cuban

Cuban, a minority owner in the Dallas Mavericks professional basketball team, has long been critical of Gensler’s clampdown of the blockchain industry.

“Gensler screws up again,” he quipped after NFT marketplace OpenSea revealed it was the subject of an SEC investigation last month.

Gensler, of course, has long contended that most cryptocurrencies fall under 90-year-old securities laws regulating stocks and bonds. By failing to register as securities, many token issuers are breaking the law, he has argued.

Even as the agency has pursued enforcement actions against a Who’s Who of crypto stalwarts — Coinbase, Binance, Kraken, Consensys — industry leaders have rebuffed the SEC in court, and in the court of public opinion.

Securities laws

Indeed, crypto influencers have even accused the Biden Administration of carrying out a broad-based, anti-crypto strategy dubbed Chokepoint 2.0.

While Republicans were quick to embrace crypto and oppose the SEC’s efforts, now Democrats are joining them on the front lines.

Congressman Torres, for instance, said this week that Gensler’s interpretation of securities law was “open-ended,” and chided the SEC chair for lumping all digital assets into the category of security assets.

Moreover, Harris, a former California attorney general and senator, has signalled she is open to recalibrating the Biden Administration’s hardline approach to crypto.

It’s telling that Harris conflated blockchain technology with other innovations such as AI. Recasting crypto in the context of global competitiveness is something the digital assets industry has long desired.

Her team reached out to Cuban to take soundings on the state of play in crypto.

Meanwhile, Trump and his family have rapidly leapfrogged from expressing support for the crypto industry agenda in Washington to launching their own “DeFi” business, World Liberty Financial.

The gambit has been pilloried by some as “mega cringe.”

Crypto market movers

- Bitcoin is up 1.6% today and reached $65,000.

- Ether has remained flat in the last 24 hours, trading at $2,620.

What we are reading

Polygon exec on how firm will lure Wall Street in $16tn tokenisation land grab — DL News

Visa to Pilot Tokenized Asset Platform on Ethereum Blockchain in 2025 — Milk Road

SUI Surges 45% in Past Week Ahead of $100 Million Token Unlock — Unchained

Polymarket Targets $50M Amid 2024 U.S. Election Betting Surge, Token Launch Expected — Milk Road

Is Bitcoin a ‘risk-on’ asset? BlackRock says think again — DL News

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.