- Bitcoin miners are selling their digital assets to hedge against the upcoming halving.

- The offloading of Bitcoin has contributed to the post-ETF price slump, according to Bitfinex analysts.

Bitcoin miners are offloading their digital assets to hedge against the upcoming “halving,” the event that will slash their rewards by half.

The selling has contributed to Bitcoin’s recent price decline, despite the buzz around spot Bitcoin exchange-traded funds being approved in January, analysts wrote.

‘Largest outflows from miner wallets ever recorded’

The price of Bitcoin rallied to a two-year high of $49,000 on January 10 on the back of the Securities and Exchange Commission approving 11 spot Bitcoin ETFs.

However, the brief surge fizzled out and it has dropped 12% to around $42,700.

Miners “used the run up in BTC as a catalyst to exit, or leverage, their positions,” analysts at crypto exchange Bitfinex wrote in a new report this week.

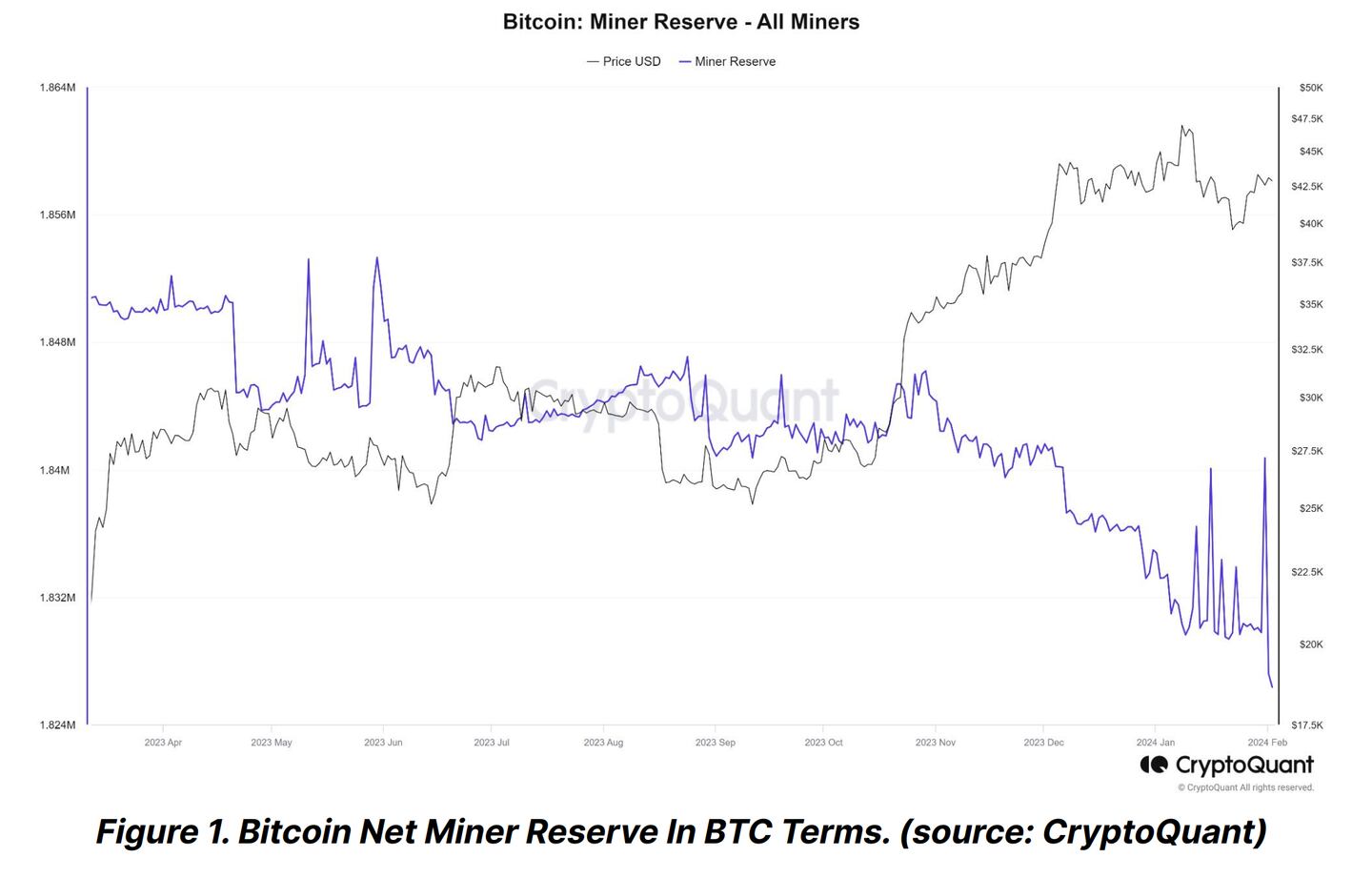

On February 1, analysts noted that about $577 million moved out of miner wallets, marking “the largest outflows from miner wallets ever recorded — suggesting that more selling could be imminent.”

The Bitcoin Miner Reserve has decreased to 1.8 million Bitcoin worth over $78.3 billion. This is its lowest level since June 2021, Bitfinex wrote.

The metric measures the Bitcoin held by miners, showing the supply they’ve accumulated but not sold.

Miners typically use the capital from the sales to upgrade their infrastructure in anticipation of the upcoming Bitcoin halving, according to Bitfinex.

The next halving is predicted to take place in April. Bitcoin miners’ rewards for confirming new blocks on the network will fall to 3.125 Bitcoin from 6.25 Bitcoin.

Past halvings have preceded bull runs as the drop in rewards creates new scarcity. The slashing of rewards increases production costs and typically creates what is known as a price floor, JPMorgan analysts said in September.

The investment bank estimates that Bitcoin’s price would trade above $40,000 following the halving, since miners will only look to sell at or above this level.

Additionally, Bitcoin mining operations are also challenged by Bitcoin’s so-called hashrate — the amount of computing power used per second — has risen at the same time as the cryptocurrency’s price, Coinbase analysts wrote in a recent report.

That means that miner revenues have barely moved despite Bitcoin soaring past its crypto winter lows.

“The increasing hashrate has likely absorbed most of the upside from higher Bitcoin prices,” Coinbase analyst David Han said.

Crypto market movers

- Bitcoin slipped by 0.7% since Monday to above $42,700.

- Ethereum fell 0.12% to trade below $2,320.

What we’re reading

- How a small Kentucky hedge fund raked in $8m on Grayscale’s Bitcoin ETF — DL News

- Crypto Funds Witness $708,000,000 Inflows; Here’s Why — Milk Road

- Former Terraform Developer Testifies Against Do Kwon: Report — Unchained

- SEC Wins Financial Data Access Against Ripple In Ongoing XRP Lawsuit — Milk Road

- AltLayer speaks out on concerns after $100m airdrop favours select users — DL News

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.