- Bitcoin ETF hopefuls await SEC's decision on ARK Invest's latest application.

- Any decision is widely expected to be delayed beyond August.

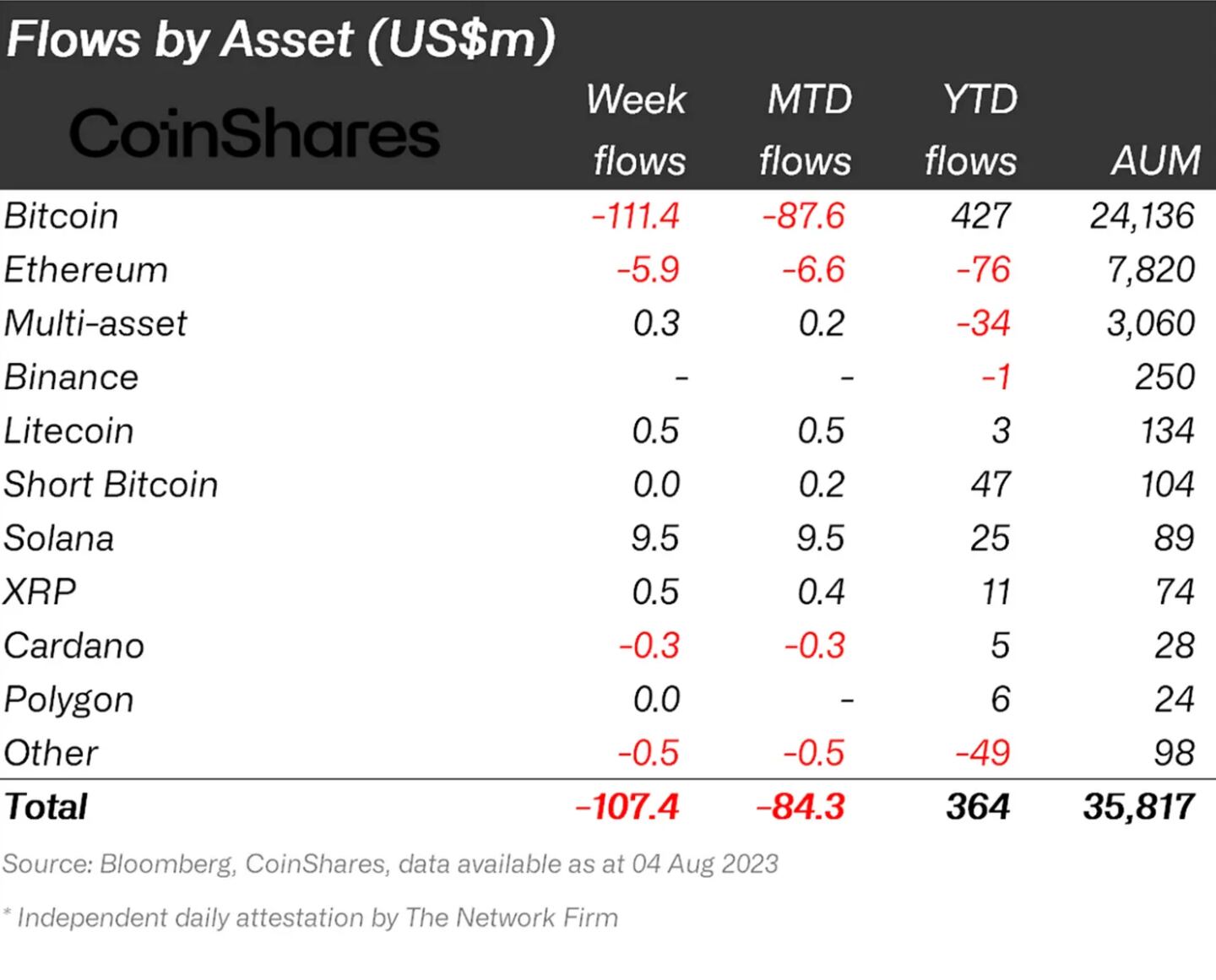

- Digital asset fund flows saw $107 million in net outflows last week.

Happy Monday!

Bitcoin exchange-traded funds are back in the news after a smattering of Ethereum ETF applications grabbed headlines last week.

Crypto watchers expect the US Securities and Exchange Commission to announce decisions to a slew of spot Bitcoin ETF applications this week, with Cathie Wood’s Ark Invest being first in line to get a nod from the markets watchdog.

Ark is in a “pole position to be approved first because they filed first,” according to Bloomberg Intelligence ETF analyst Eric Balchunas.

Bitcoin ETF summer

The recent surge in crypto markets have been partially attributed to financial powerhouses like BlackRock, Fidelity, Valkyrie, and Ark Invest applying to launch spot Bitcoin ETFs in recent months.

The SEC’s decision is expected by this week, according to Bloomberg Intelligence analysts. The SEC has a deadline to respond within 45 days of the applications being filed.

However, more cautious watchers say Ark could be waiting until January 10, 2024, according to estimates, based on a filing date of May 15, 2023.

It may be a massive boon to the industry if either of these applications proved successful. While several industry players have tried to launch a spot-based product over the past decade, a successful US launch has so far eluded asset managers as the SEC has remained hesitant to accept one due to market manipulation fears.

The SEC delayed its decision on the rule change proposal to list a first-of-its-kind physical carbon allowances ETF last month. Spot Bitcoin ETFs are going through the same process and could face similar delays, analysts noted.

That denial could be bad news for spot Bitcoin ETF hopefuls, Balchunas said. That’s because the process for the carbon ETF is the “exact same” as the spot Bitcoin ETFs, he said.

Profit taking continues

Digital asset funds experienced net outflows of $107 million over the past week, according to data collected by asset manager CoinShares.

Bitcoin products saw $111 million in outflows, the largest week for outflows since March, CoinShares head of research James Butterfill wrote.

Profit-taking has gathered pace in recent weeks, Butterfill said, adding that “the summer doldrums are in full force with weekly trading volumes in investment products 36% below the year-to-date average.”

Crypto market movers

- Bitcoin gained 0.1%, while Ethereum added 0.3% over the past 24 hours.

- Ripple’s XRP fell 0.76%, last week a judge in the Terra case in Manhattan said cryptocurrencies are securities regardless of how they are sold, dampening the euphoria around Ripple’s court ruling in July. But as a prominent crypto lawyer told DL News this week, the case may still hold sway in future cases.