- Bernstein estimates Bitcoin will reach $1 million in 2033.

- Institutional players getting into ETFs is key for the rally.

Bitcoin will skyrocket to $200,000 in 2025 and exceed $1 million by 2033, according to Bernstein.

How will the cryptocurrency break those records? By leveraging institutional players’ growing interest in spot exchange-traded funds.

“We see Bitcoin ETFs as on the cusp of approvals at major wirehouses/large private bank platforms” over the second half of the year, analysts at the research firm Gautam Chhugani and Mahika Sapra wrote in a report this week.

The comments come as spot Bitcoin ETFs have seen over $15 billion in inflows since launching in January.

While hawkish comments from the Federal Reserve may have triggered $620 million in ETF outflows last week, Bernstein’s bullish outlook suggests any pain from it will be short-lived.

Bernstein shared several charts to back up its argument.

Demand

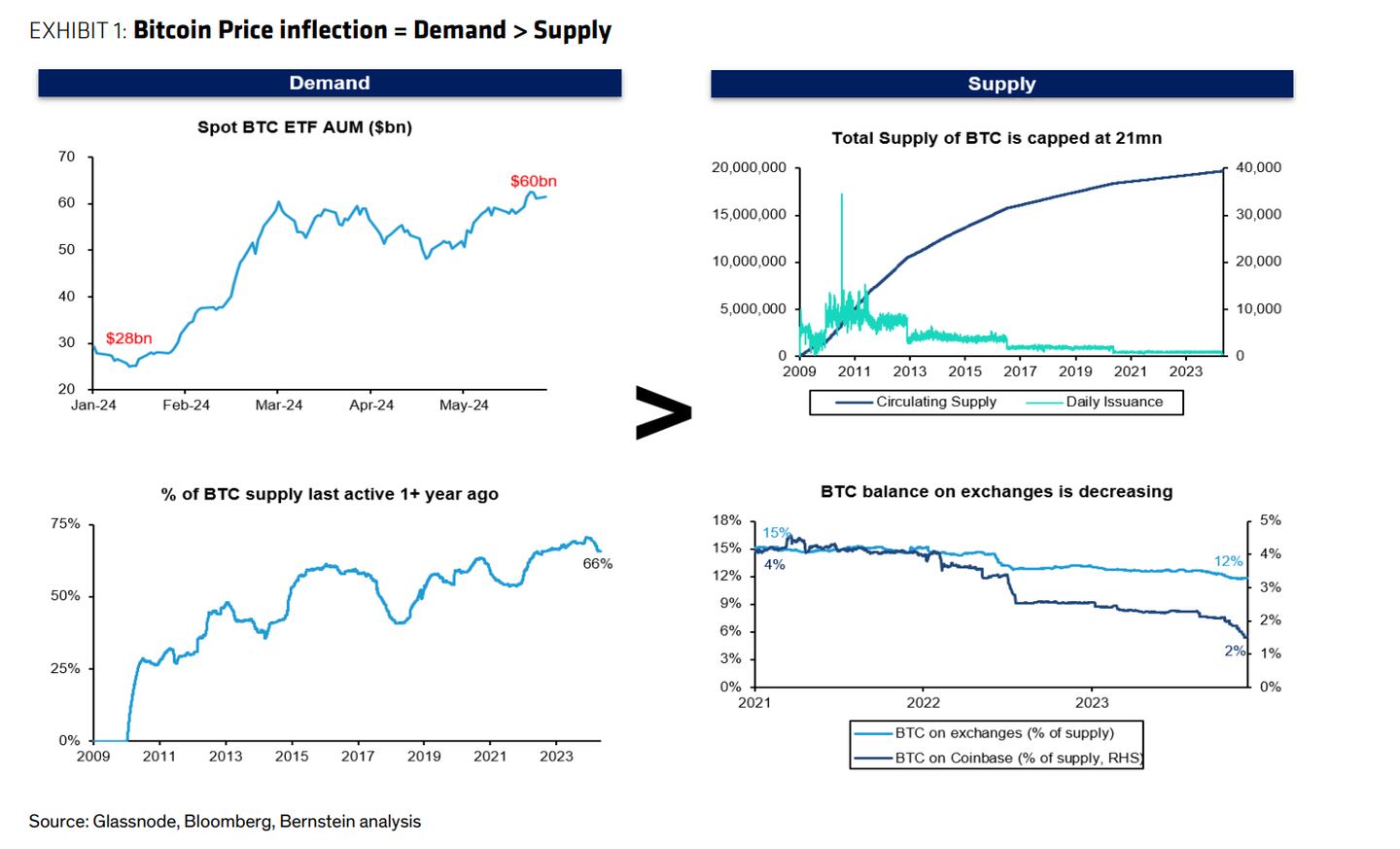

The launch of spot Bitcoin ETFs have driven a 57% surge in the cryptocurrency’s price in 2024.

More institutional players — such as retail and asset managers, wirehouses, institutional funds — will tap into the asset class, which will fuel demand, Bernstein wrote.

ETFs are expected to grow their holdings of the total amount of Bitcoin to 15% in 2033 from 4%.

At the same time, supply remains fixed, with Bitcoiners’ penchant for holding the limited asset over a long time. Some 66% of Bitcoin has not moved for over a year.

High demand combined with low supply is a recipe for higher prices.

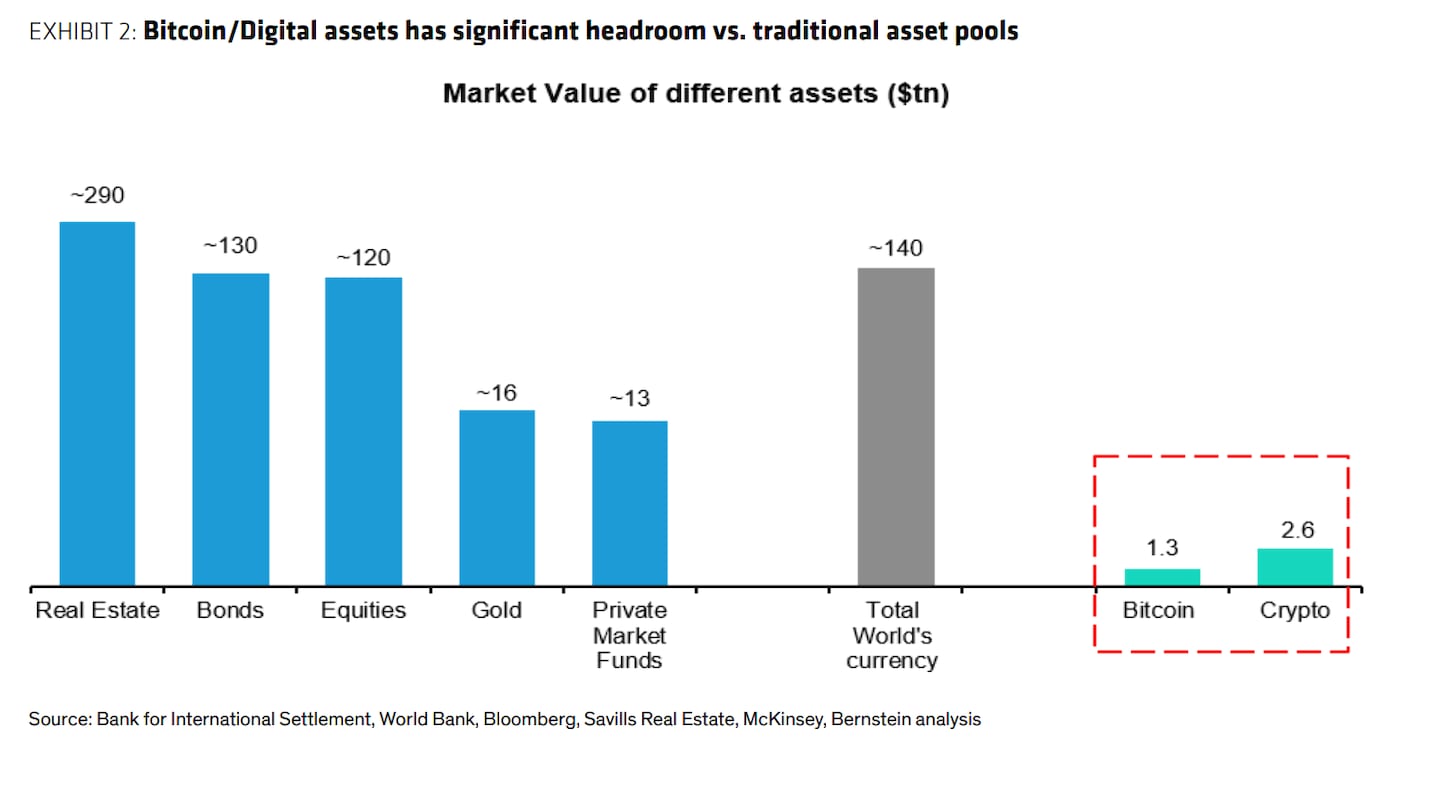

Space to grow

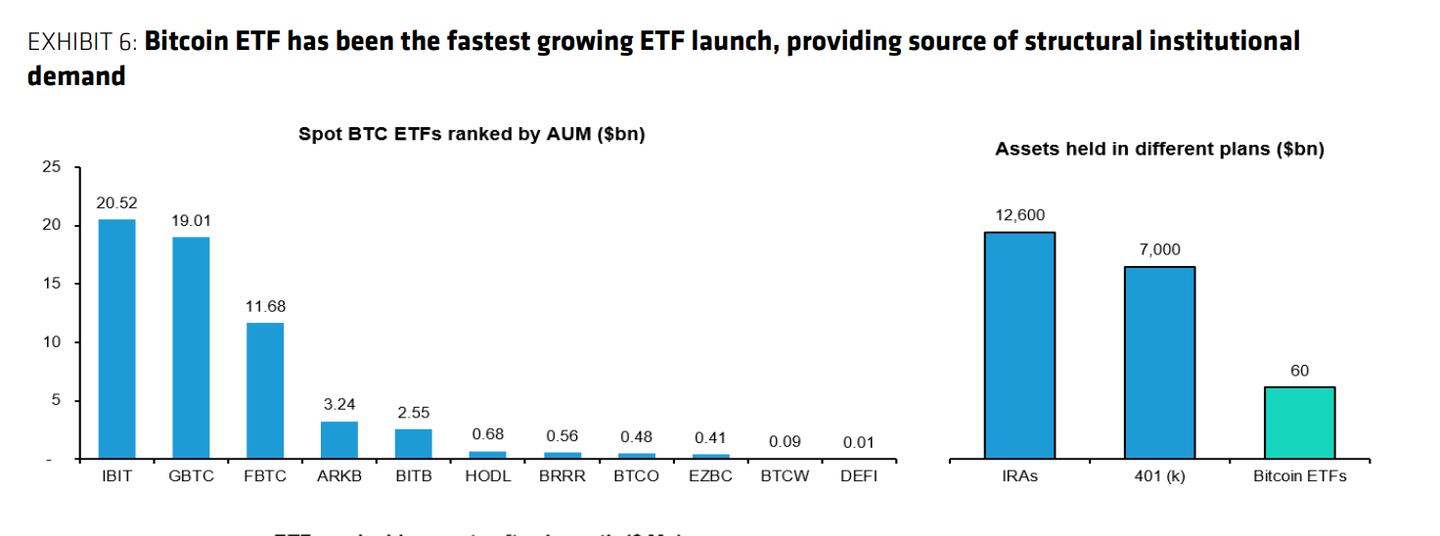

Bitcoin ETFs have smashed records, with some $60 billion under management across these funds.

Chhugani and Sapra said more is to come.

“Growth will be driven by larger advisors approving ETFs and substantial allocation headroom within existing portfolios,” Bernstein wrote.

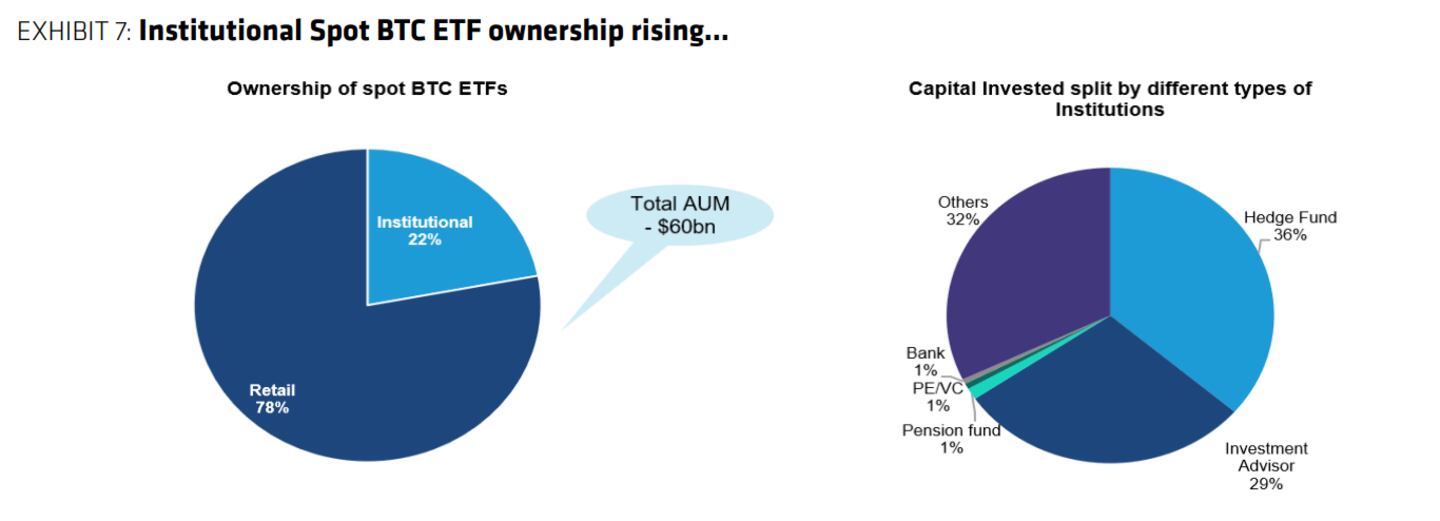

They said that while retail investors own 78% the funds in spot Bitcoin ETFs, institutional players have started to do some initial crypto trades, suggesting that the percentage will grow.

Cycles

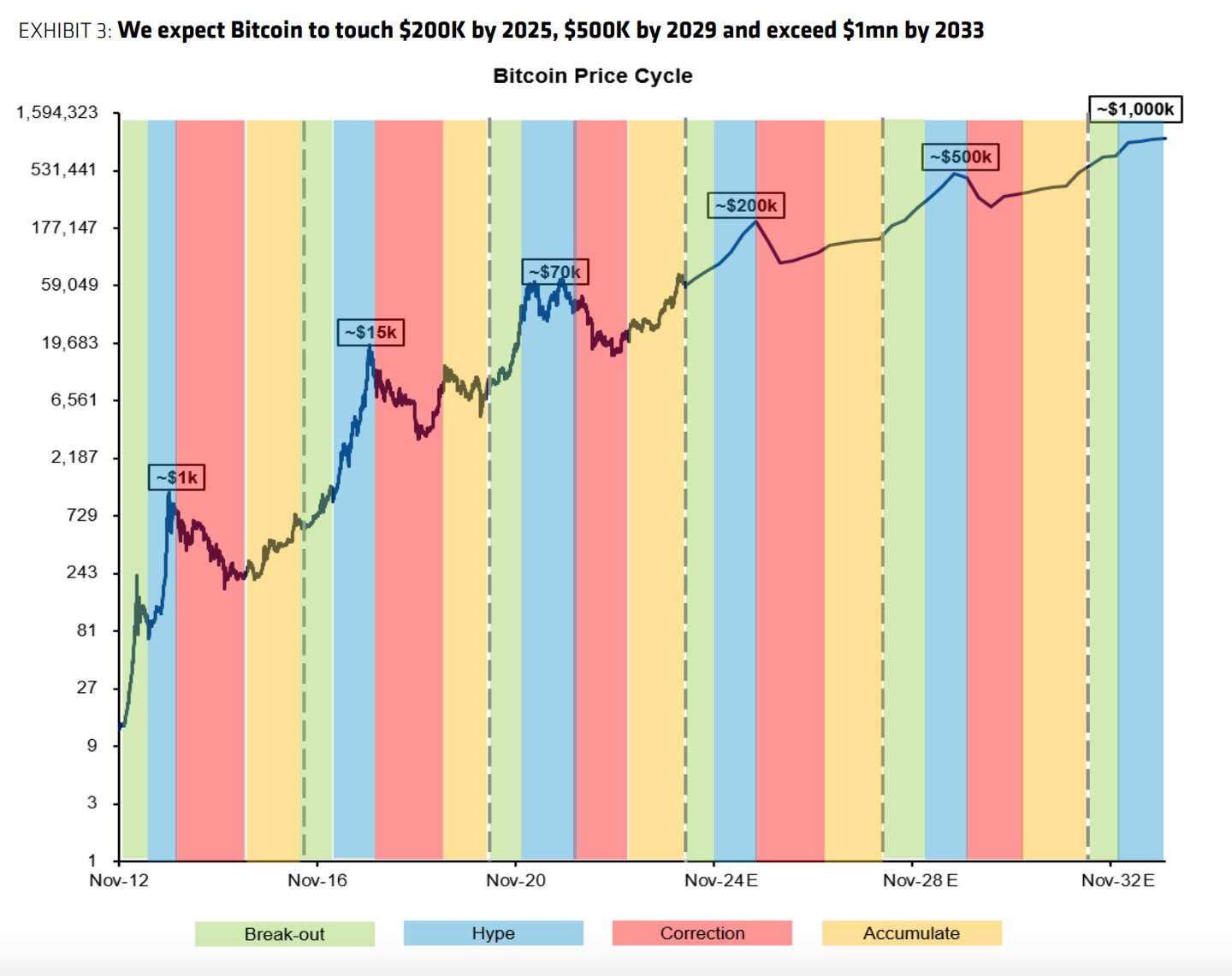

Chhugani and Sapra argued that Bitcoin grows in cycles, marked by so-called halving events every four years..

Past halvings have triggered a break-out phase when the price begins to rally; a hype face when it really begins to shoot up, a correction phase when overvaluations are corrected, and an accumulation phase when things get back to normal.

Each time a halving has happened, the price has surged, which Bernstein said will happen again over the next nine years.

Crypto market movers

- Bitcoin is down 0.3% to $65,030 over the past 24 hours.

- Ethereum is up 0.3% to $3,520.

What we’re reading

- Trump campaign is not involved in DJT: insider — DL News

- India Slaps Binance With $2.2 Million Fine Over AML Violations — Milk Road

- Jupiter Co-Founder Meow Proposes 30% Cut to JUP Supply, Sparking 7% Gain — Unchained

- CertiK Claims Responsibility For Identifying Kraken’s Critical Bug, Sparking Controversy — Milk Road

- Crypto hedge fund Pantera to pour $200m into AI: ‘Everyone will be using AI’ — DL News

Eric Johansson is DL News’ News Editor. Got a tip about the election? Reach out at eric@dlnews.com.