- Questionable trading bedevils NFT market, particularly on the Ethereum network where it accounts for half the trading volume.

- A fifth of the trading volume on Blur, a leading NFT marketplace, over the past three months was attributed to wash trading.

Happy Monday!

About half of the NFT trading activity on Ethereum in the past day is linked to wash trading. While trading volumes are up for popular collections including CryptoPunks and Bored Ape Yacht Club, it’s hard to discern what is real what isn’t.

Let’s dig in!

Wash trades

While not unique to crypto, wash trading has proliferated in recent years, particularly when it comes to nonfungible tokens.

NFT wash sales on Ethereum were up 30% to $4.7 million in the last 24 hours, according to CryptoSlam data. This accounts for about 50% of all NFT sales on the blockchain since Sunday.

Wash trading occurs when one person buys and sells the same assets simultaneously to artificially increase activity. It’s a form of market manipulation, and is designed to mislead market participants.

A recent report on wash trading on decentralised exchanges has been hotly contested.

The study seemed to uncover genuine wash-trading in long-tail assets, Nagaking, a Curve Finance grantee who studies DeFi market structure, told DL News. Its results were “far from generalizable to DEXs more broadly,” he added.

Wash-trading isn’t a profitable strategy for the large majority of tokens, Nagaking said. Volumes on these DEXs tend to be dominated by arbitrage and directional betting.

When it comes to NFTs, the landscape is a lot different — and incentives on burgeoning exchange’s play a role.

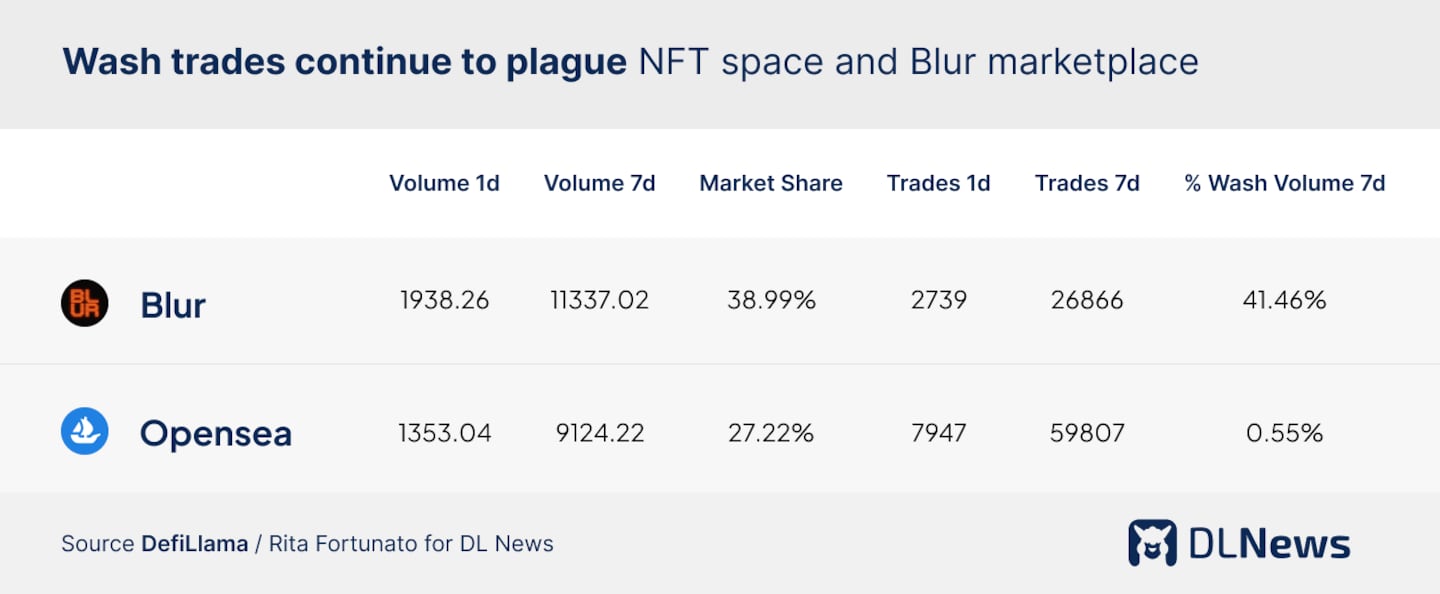

Wash trading accounted for just over 40% of trades on NFT marketplace Blur over the past week, according to DeFiLlama data. This is a stark contrast to archrival OpenSea, which recorded only 0.5% of these questionable transactions.

Since July, 20% of the total trading volume on the Blur, which lanuched little more than a year ago, was attributed to wash trading, according to a Dune Dashboard by Hildobby, a data scientist at crypto venture fund Dragonfly. That’s about $220 million.

While questionable trades account for a fifth of the total volume on Blur, it doesn’t dominate individual trades. Only 3.5% of trades on Blur are attributed to wash trading by Hildobby’s dashboard.

Blur incentivised users to trade on its platform by promising a token airdrop. Its top users would receive free tokens, which they could then sell on the secondary market and profit from their activity on the platform. Users have since started to “point farm” in anticipation of the platform’s next airdrop.

This led some users to trade collections like Bored Ape Yacht Club in order to increase their activity.

While NFT activity is up on the Ethereum blockchain, it continues to be plagued by wash trading.

Crypto market movers

- Bitcoin fell 2% in the past day.

- Ethereum is down 1.6% since the weekend.

- Altcoins fell at a sharper pace, with Ripple’s XRP down 3% and Polygon’s MATIC losing 2.2%.

- Toncoin continues to fall after it was catapulted into the top ten cryptocurrencies by market capitalisation on CoinGecko. The token is down about 2% since Sunday, and over 11% in the last week.

What we’re reading

- Why Maple is ditching under-collateralised lending: ‘No one’s profitable’ — DL News

- Banks are clueless about blockchain — DL News

- Surprising report finds 41% of asset managers see ‘very strong’ crypto growth ahead — DL News

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.