- Ark Invest’s trades are closely watched.

- The fund manager's active management strategy means it will often appear to sell winning stocks.

- Cathie Wood’s firm often rebalances its allocations.

Cathie Wood’s flagship exchange-traded fund just had its best month on record, notching a 31% gain. Now, the fund manager is garnering attention from the stocks she didn’t hold.

Here’s why!

Balancing act

Ark Invest has been a Coinbase shareholder since its initial public offering in April 2021. The firm has also long been bullish on Bitcoin, with founder and CEO Cathie Wood predicting the digital asset will reach a price of $1.48 million by 2030.

The asset manager added 750,000 Coinbase shares to three of its fund’s on the first day of trading in 2021. Onlookers have carefully watched Wood’s holdings ever since.

Over the past week, Ark has been busy selling Coinbase shares. On Tuesday, the asset manager sold over $30 million worth of shares in the crypto exchange across three ETFs, according to a trade filing. Ark sold around $15 million Coinbase shares last week.

Wood probably hasn’t gone cold on Coinbase, though.

Ark Invest will often sell into rallies — Coinbase is up 62% in the past month, for instance — and buy into dips. This tactic is typical to rebalance desired weightings in each individual fund, as analysts said in July.

Take the firm’s flagship fund, the Ark Innovation ETF. Wood sold just under $4 million worth of Coinbase shares from this ETF on Tuesday. Coinbase’s weighting in the fund increased to 11.6% from 7.8% at the end of September.

In this period, the crypto exchange’s share price soared 86%, and is up over 300% year-to-date.

Ark Invest likes to keep Coinbase’s weighting at around 9% of this fund. So when prices jump exponentially more than other assets in the ETF, Ark will offload shares — taking profit in the process — to keep its holdings equally distributed.

Coinbase remains the top holding in the Ark Innovation ETF, with $960 million worth of shares. It’s also the top holding in two other funds. The Ark Next Generation Internet ETF and the Ark Fintech Innovatoin ETF. Its weightings in these funds are well above September levels at 11.7% and 13.1%, respectively.

It shouldn’t come as a surprise if Wood sells more Coinbase shares soon. It’s all part of a balancing act.

Crypto market movers

- Bitcoin traded above $44,000 shortly after 2 pm UK time, its highest level since early April 2021.

- Ethereum gained 2.5% to trade around $2,260.

What we’re reading

- Binance CEO makes London debut with combative tone and new promise — DL News

- Stablecoin FDUSD crosses $1bn mark as Binance launches zero-fee trading — DL News

- Bitcoin Mempool Reaches Record Levels of Congestion — Unchained

- CNBC Predicts Bitcoin To Surpass Gold Scarcity As BTC Hits $43,000 — Milk Road

- Charlie Munger Engages In Crypto Debate With Stripe Founder, Deems It A ‘Store Of Delusion’ — Milk Road

- Bitcoin Defies Slump in Risky Assets to Trade at 19-Month High — Bloomberg

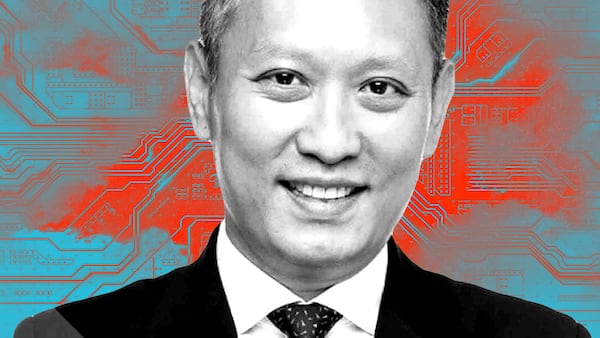

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.