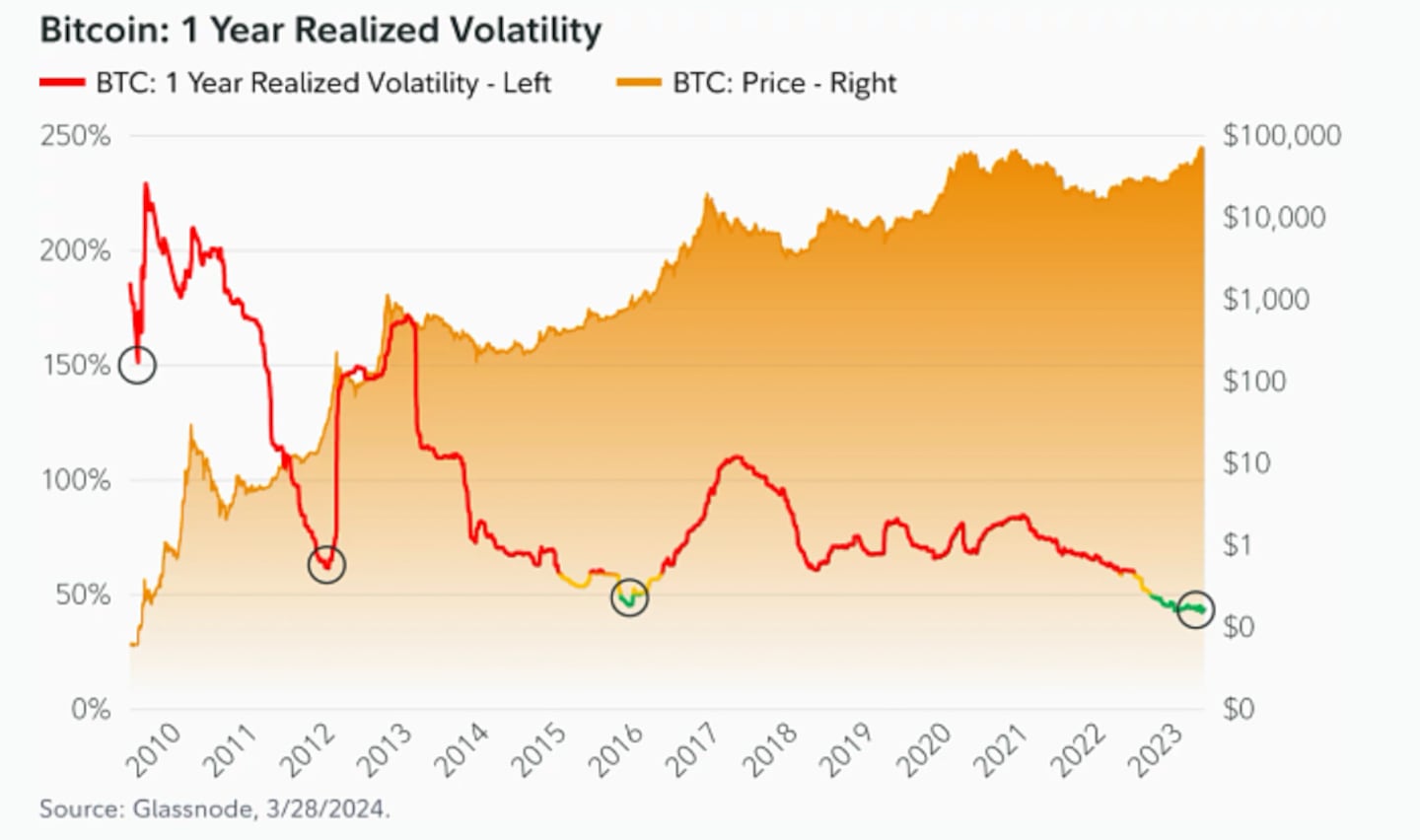

- Bitcoin’s volatility is at historic lows.

- The top crypto could soon make a big move upward, Fidelity predicts.

- Bitcoin’s volatility has been declining over the years as the asset matures.

Bitcoin is traditionally seen as a risky asset, but its volatility isn’t constant — it ebbs and flows as the market enters manic phases, and cools off again.

What’s more, the top cryptocurrency’s volatility has reached historic lows in the last 12 months, even though its price hit an all-time high.

It’s a sign that Bitcoin could soon experience another massive price increase, Fidelity Investments research analyst Zack Wainwright wrote in a May 1 report.

Studying Bitcoin volatility

The prediction comes as Bitcoin has recovered from the wobble that saw it fall below the $57,000 mark last week. It’s currently trading at above $63,600.

With volatility reaching historic lows, traders should prepare for Bitcoin to become more valuable — if only because there are little to no signs of trading mania.

“Investors have historically experienced large price increases in short periods of time once all-time highs in price were revisited and subsequently broken under these circumstances,” Wainwright said.

Price appreciation tends to culminate with Bitcoin volatility rising to high levels, Fidelity said, indicating that speculation has become rampant and the market is overheated.

The exception, Fidelity noted, was the 2021 bull market.

“Global events like the Covid-19 pandemic can vastly change the trajectory of any market, Bitcoin included,” Wainwright said.

The report also said that Bitcoin volatility was falling over time.

In fact, Bitcoin has been less volatile than some big tech stocks — like chipmaker Nvidia, electric-car maker Tesla, and Facebook owner Meta Platforms — this past year.

Bitcoin’s decreasing volatility shows that the asset is maturing in the eyes of investors, Fidelity said. And that may be why it managed to climb to a new all-time high in March while keeping low volatility.

Bitcoin was nearly half as volatile in 2024 at $60,000 when compared with 2021 at the same price, Wainwright said.

Another asset that has behaved similarly? Gold.

Gold’s volatility was almost twice as high in 1980 than Bitcoin’s in April 2024, Fidelity said.

“Once gold became a recognised asset class and the market settled on a longer-term price range, volatility declined as well,” Wainwright said.

Crypto market movers

- Bitcoin is down 1% over the past 24 hours to trade at $63,600.

- Ethereum dropped 3.6% to trade at just over $3,000.

What we’re reading

- A jailed Binance exec, a $35m money laundering case, and an Interpol manhunt — how Nigeria’s crypto crisis unfolded — DL News.

- The Best Bitcoin Wallets of 2024 — Milk Road.

- ‘Don’t Be Stingy’ About Token Airdrops Says Uniswap Founder — Unchained.

- The Best Solana Wallets Of 2024 — Milk Road.

- Why Hong Kong crypto custodians and exchanges are sparring over customer assets — DL News.

Tom Carreras is a markets correspondent at DL News. Got a tip about Bitcoin? Reach out at tcarreras@dlnews.com.