- Web3 gaming may have new laws in place in France later this year.

- French regulators opted to work with unicorn Sorare instead of taking punitive action.

- France is racing ahead with DeFi regulation as Europe implements its crypto rulebook.

In 2022, Sorare, a French sports fantasy platform, was offering NFTs featuring many of the world’s top football players, including Lionel Messi. The values of the digitally watermarked cards would ebb and flow with their performances on the pitch.

Still, officials at the French National Gaming Authority, or the ANJ, didn’t like what they saw.

They were worried consumers, especially minors, may not understand the risks of buying Ethereum-based digital collectibles, and launched an investigation, informing Sorare it was violating gambling laws.

Fashioning new rules

Rather than take punitive action against Sorare, however, the ANJ sat down with its executive team and collaborated on fashioning rules to control the distribution of NFTs and establish that trading the instruments was not the same as gambling. Since last year, the company has adjusted its policies to fit the regulator’s expectations.

Now, French lawmakers are drafting a bespoke bill for NFTs and for building guardrails around digital objects that have monetised values within virtual games.

An agreement on a new set of rules for NFTs in web3 games may come within a few months.

NOW READ: Pricey NFTs and not enough fun — here’s why the web3 gaming revival is fizzling out

The framework, known as JONUM, has passed a first reading in the upper house of the French parliament. It was handed over to the National Assembly in July, where lawmakers will pick up discussions after the summer break.

What’s striking about the development is that regulators were careful not to take damaging action against Sorare. The French government, led by President Emmanuel Macron, has vowed to support and stimulate the development of a crypto hub in Paris.

“Since Sorare is a unicorn, the ANJ didn’t want to prevent it from doing business,” said Stéphane Daniel, partner at Paris-based law firm d&a partners.

Same laws

This contrasts with the approach of US authorities such as the Securities and Exchange Commission. It and other agencies are demanding crypto firms comply with the same laws that control securities like stocks and bonds. Industry leaders such as Coinbase CEO Brian Armstrong have complained the SEC isn’t negotiating in good faith.

In France and the European Union, meanwhile, officials are setting up bespoke regulations for blockchain-based products, including NFTs.

Need to be creative

“France will be the first country in the world to legislate in this sector,” a Sorare spokesperson told DL News. “We need to be very creative in defining appropriate regulations without copying those derived from a legacy model, namely gambling.”

Sorare, developed in 2018, is one of the leading web3 firms in France. It was valued at $4.3 billion in 2021 after a $680 million raise and has since teamed up with the UK’s Premier League football as well as the National Basketball Association to launch NFT collectibles.

NOW READ: Macron stokes Paris crypto scene with tax breaks and clear rules, but will VCs remain wary?

Argentine superstar Messi also became an investor and ambassador for Sorare.

On the platform, users collect and mint digital player cards, as well as buy, sell and trade them within the game. Users can form their own teams and compete against each other, with scores determined by real-life performances.

Very friendly with crypto

Macron’s government has pushed favourable tax breaks, years of regulatory clarity and a supportive ecosystem for bootstrapping startups. This may have helped Sorare stay out of trouble.

“The French Markets Authority is very friendly with tech and also crypto projects, so they did not crack down on Sorare,” Daniel told DL News. “Instead, discussions were initiated and they wanted to understand how it works.”

‘The French Markets Authority is very friendly with tech and also crypto projects, so they did not crack down on Sorare.’

— Stéphane Daniel

If passed, the law will exempt the platforms from gambling rules but enforce user identification, anti-money laundering provisions, a ban on minors, reports to regulators, and mandatory disclosures.

While dialogue with regulators works better than aggressive legal action — a strategy more common in the US — the industry remains wary of putting early restrictions on developing technologies.

First to legislate

Web3 developers worry that a restrictive framework would stifle gaming innovation and drive businesses to more competitive regions like the US or Asia.

There is a difference in financial risk to consumers and the “liberty to spend pocket money at will,” said Jeffery Haas, web3 gaming adviser and venture partner at DreamCraft VC in Copenhagen.

NOW READ: French regulators race to get a jump on MiCA and make Paris Europe’s web3 hub

“France doesn’t regulate Panini football cards or Magic: The Gathering cards, so do they really need to regulate the purchase of €5 NFTs just because it’s exactly the same thing but on a blockchain?” Haas told DL News.

The ANJ president, Isabelle Falque-Pierrotin, said at a Paris event in July that she understood the industry doesn’t want an “administrative straitjacket that prevents them from innovating.” Still, she held the line that a regulatory foundation is a “good recipe for business.”

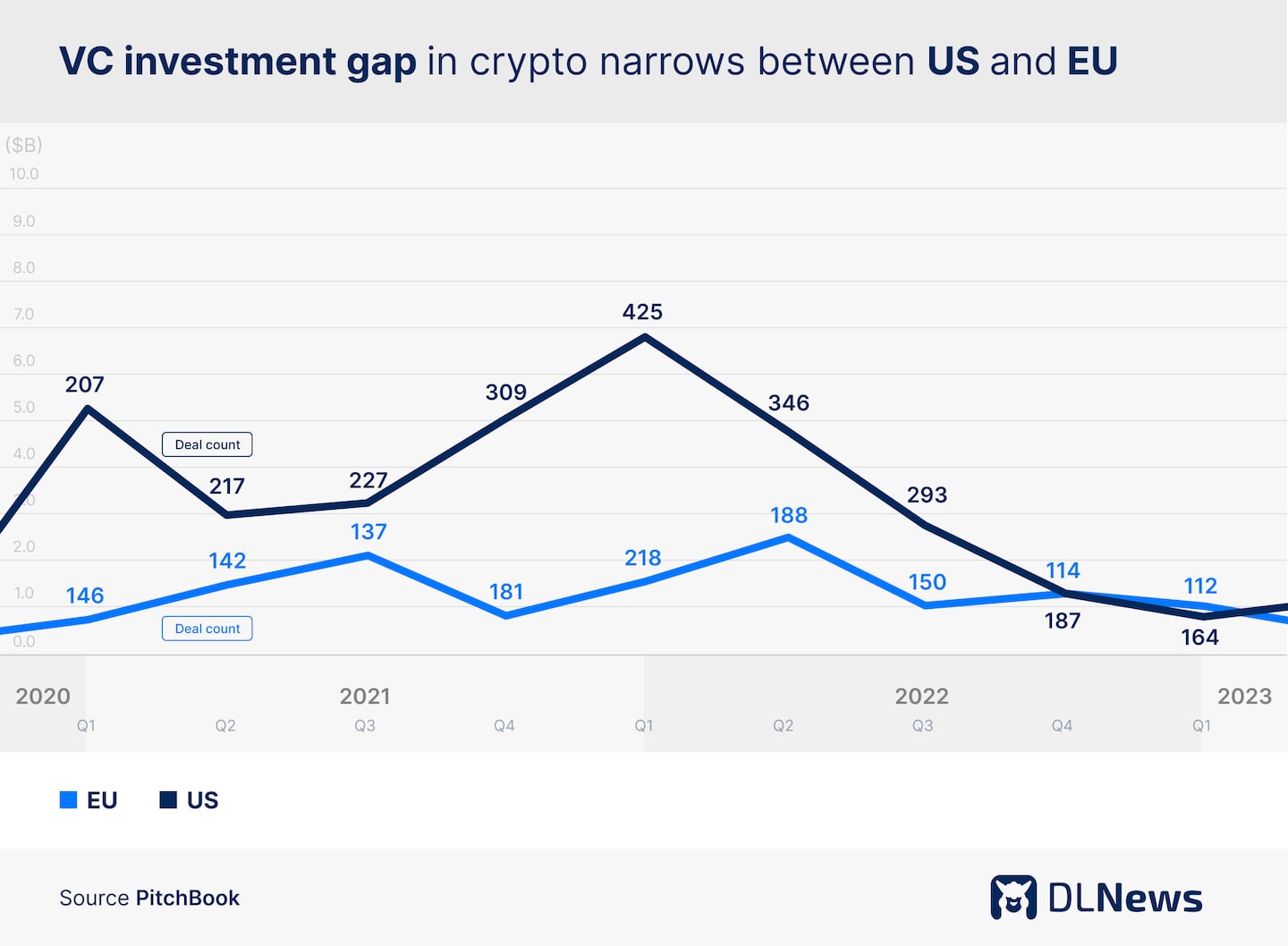

Indeed, data from PitchBook shows that the gap between Europe and the US in VC funding into blockchain has narrowed over the past year. The US filed lawsuits against crypto actors, while the European Union laid down its regulatory path.

The French NFT bill comes as the EU is implementing its rulebook for crypto assets, or the Markets in Crypto-Assets regulation, from which NFTs and decentralised finance were largely excluded.

Instead, MiCA appointed the European Commission to monitor and report on developments in DeFi by Dec. 30, 2024, which may lead to a new set of regulations that some have already dubbed MiCA II.

Clear-cut legislation

“It seems that France is trying to preempt those topics, to establish national laws that could then be reused at the level of the EU,” Daniel said.

France previously jumped ahead in 2019, regulating crypto with clear-cut legislation set up for virtual asset service providers. Many point to this early framework as the godmother of MiCA.

Now, the country is racing forward with its own surveys of DeFi. The French banking authority earlier this year published a paper to unpack DeFi and collect feedback. Industry advocates have highlighted concerns about regulatory proposals frustrating innovation.

The French markets regulator, AMF, followed suit and published its own take on DeFi in June, calling for for a “same risk, same regulation” approach.

The industry continues to stress that moderation in regulating the sector in its early stages is essential.

“The choice is simple: make France the world leader in web3 gaming or allow the industry to disappear from the country,” the Sorare spokesperson said.

Inbar Preiss is a Brussels-based regulatory correspondent for DL News. Contact the authors with story tips: inbar@dlnews.com.