Gemini agrees to mediation over Genesis crash

Gemini has agreed to a mediation period with Digital Currency Group to resolve the Genesis Global conflict and potentially return hundreds of millions in funds to customers.

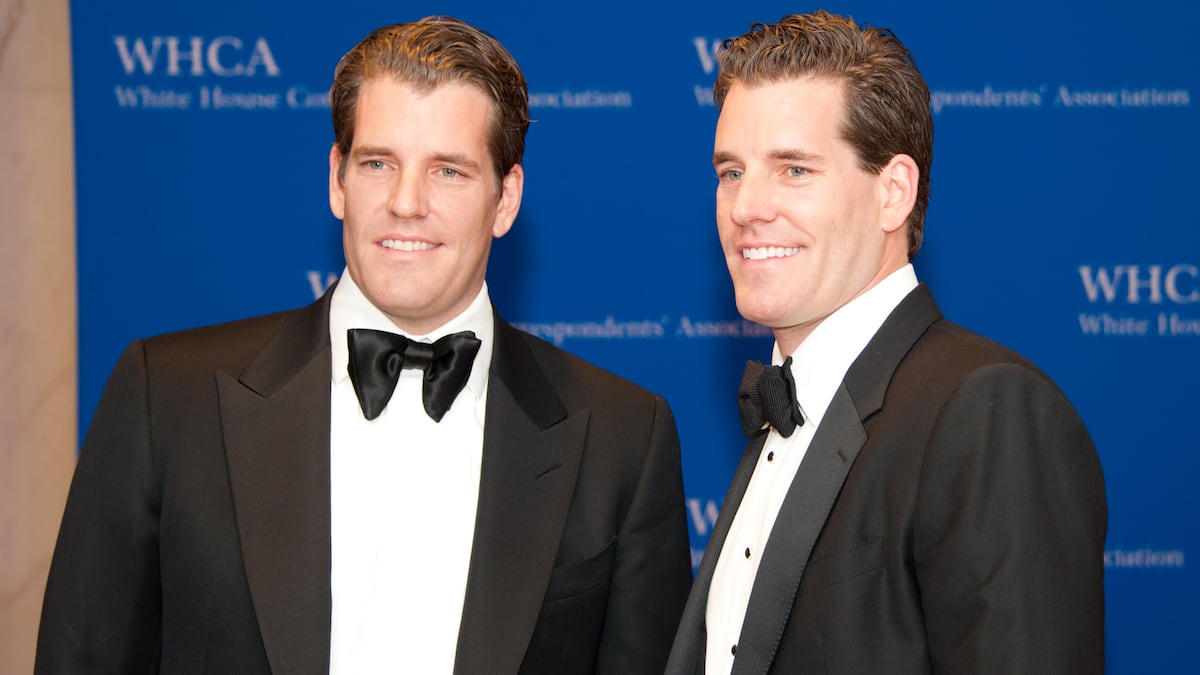

The exchange, run by the Winklevoss twins of Facebook fame, said it has agreed to a 30-day mediation process with crypto conglomerate DCG, which owns the defunct lending company Genesis Global.

The mediation agreement is between Gemini, DCG, Genesis Global, the Unsecured Creditors Committee and the Creditor Committee.

The defunct lending programme Gemini Earn is at the centre of the conflict. The programme allowed users to deposit their cryptocurrencies and receive yield on their assets, similarly to how a bank works.

Genesis Global was the primary partner for the service. Over $766 million of users’ funds lent through the service has been stuck in limbo since the company filed for bankruptcy in January.

Gemini and DCG reached an agreement in principle in February to make Earn users whole. The plan would see Gemini contribute $100 million to Earn users.

NOW READ: Secretive trading firms that pile into crypto are ‘first sign’ of mainstream adoption

Bitcoin network transactions reach all-time high

Bitcoin transactions reached new all-time highs on a seven-day moving average on Saturday. In that period, over 408,000 transactions took place on the blockchain, up from the previous 406,000 record.

So-called inscriptions — metadata added atop the smallest unit of Bitcoin measured — seem to be contributing to the increased activity.

Inscriptions utilise NFTs called Ordinals to store data at an estimated seven times cheaper than on the Ethereum network, allowing for workarounds of Bitcoin’s historically slow and expensive network.

NOW READ: Traders pile $6.4bn into Ether options as bulls dominate before expiry

Binance executive says investment arm strong despite US crackdown

A top Binance executive highlighted a $1.5 billion gain in the firm’s Binance Labs investment arm as evidence US regulations will not slow the company down.

Chief Business Officer Yibo Ling said in an interview that US regulations “don’t touch” Binance Labs, which saw an increase in asset management from $7.5 billion to $9 billion over the last year.

Binance Labs invests in upstart crypto projects in over 25 nations, despite fewer announced investments over the past year.

Binance Global — the leading crypto exchange by volume worldwide — is currently being sued by the US Commodity Futures Trading Commission for unregistered trading activity in the US.

Man who stole $20m in Bitcoin from brother faces four years in jail

An American citizen was sentenced to over four years in prison for Bitcoin theft, according to the Us Department of Justice.

Gary James Harmon pleaded guilty to the theft of 712 Bitcoin — worth over $20 million today — from his brother Larry Dean Harmon.

Larry Harmon is in hot water himself, after his 2020 arrest for operating Helix, a coin-mixing service associated with darknet transactions.

NOW READ: Merlin’s $1.8m heist highlights role of code auditor CertiK: ‘This should have been captured’

Franklin Templeton launches mutual fund on Polygon

Investment giant Franklin Templeton launched an on-chain mutual fund on the Polygon network last week. The move marks the $1.4 trillion firm’s largest foray into the crypto space to date.

The Franklin OnChain US Government Money Fund operates similarly to a stablecoin, with a $1 peg that aims to provide investors with dividends from assets under management including government securities and repurchase agreements.

The integration to Polygon, a leading Ethereum sidechain, is the latest example of institutional interest in the crypto space.

We are excited to announce that the Franklin OnChain U.S. Government Money Fund is now supported on the @0xPolygon blockchain. Learn more: https://t.co/TxOBSILNOt

— Franklin Templeton Digital Assets (@FTDA_US) April 26, 2023

Explore $FOBXX: https://t.co/dHfKH2Si8Z pic.twitter.com/pDgKtIUvcc

US lawmaker McHenry sets two-month timeline for crypto bill

US House Financial Services Committee Chair Patrick McHenry set a two-month timeline for new crypto legislation put forth by the FSC and the House Agriculture Committee.

McHenry told crowds at last week’s Consensus 2023 event that the pending legislation would address the ongoing spat between the US Securities Exchange Commission and Commodities Futures Trading Commission over issues of crypto jurisdiction, with the end result being a “deal out” between the two agencies.

If successful, the bill would be the first comprehensive framework for crypto legislation in the US.

NOW READ: Congress clashes over plumbing of crypto markets

More web3 news from around the web...

Marvel Studios founder says web3 has ‘same seed’ of his early Marvel days — CoinDesk

Solana has outperformed Bitcoin and Ethereum since January thanks in part to Mad Lads NFTs — Fortune Crypto

Crypto-friendly Cross River Bank faces FDIC scrutiny over ‘unsafe’ practices — The Block