- More than 1,000 memecoin pairings have been created this week alone.

- Pump-and-dumps and Ponzi schemes are rampant, say crypto analysts.

- Memecoins may be nuts but they are also a big part of crypto culture, say defenders.

Memecoins are a scam. Long live the memecoin.

That’s the dichotomy at hand as hundreds of joke-tokens flood the $2.6 trillion cryptocurrency market each week and post jawdropping returns.

Coinye West, a 13-day-old memecoin on Coinbase’s Base network, has already multiplied in value 115 times.

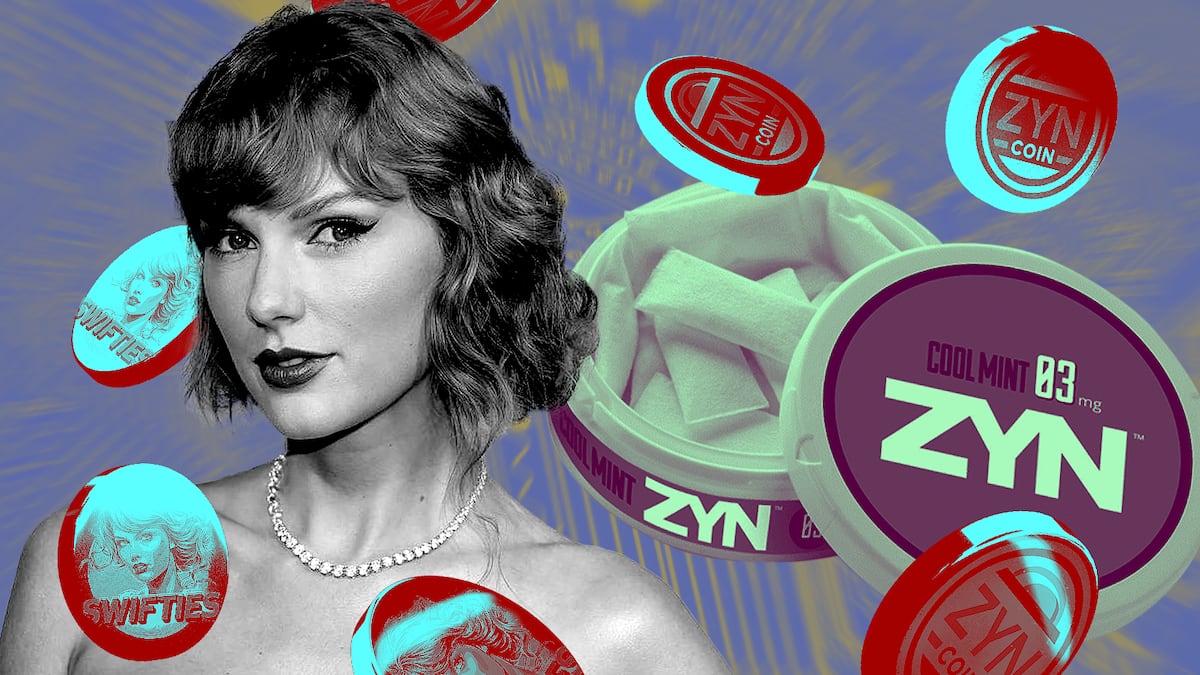

Last month, SWIFTIES, a Solana-based token named after the pop star Taylor Swift, skyrocketed 200 times in a few hours.

Another one, Jeo Boden — essentially a weird drawing of the US president — skyrocketed 1,000 times since its launch on March 3.

The memecoin market, which didn’t even used to be a thing not too long ago, is now worth $58 billion, according to CoinGecko.

More urgently, the memecoin craze is also raising fears that this latest edition of the crypto pump-and-dump game is tarnishing the industry just as it’s won mainstream acceptance with the advent of Bitcoin ETFs.

“Most aren’t value creation, but just value moving from the most naive folks to the folks who are most willing to take their money,” Taylor Monahan, a MetaMask security researcher, told DL News. As one of the larger crypto wallets on the market, MetaMask is a key tool for traders looking to flip memecoins.

“I’m not sure what these memes are actually trying to create, value-wise.”

Identity and community

But maybe memecoins are just another form of crypto expression, tokenised riffs on stuff making the rounds on social media. To that end, some are funny, but others are offensive.

While it may be hard for traditional investors to get their heads around the idea of instant asset creation, these tokens are rapidly becoming a fixture in the blockchain ecosystem, for better or worse.

“They are based on identity and community,” Juan Bruce, co-founder of the Solana-based social media platform DSCVR, told DL News. Bruce added that the DSCVR team works closely with memecoin projects.

“They’re actually similar to NFT collections, real-world collectables, and fashion accessories that emphasise community, brand identity and belonging.”

One thing is certain — they are reshaping the crypto narrative just a couple of months after BlackRock CEO Larry Fink and his peers stamped Bitcoin with Wall Street’s seal of approval.

That act helped tip crypto into the bull market, setting the stage for so much memecoin creation.

But does this mean institutional investors won’t take crypto seriously?

“These two points are separate,” Wilson said. “Despite the prevalence of memes and the occasional unserious aspects within this industry, we continue to witness the involvement of major traditional financial entities, like BlackRock, with no signs of this slowing down.”

In any event, the latest memecoin rally comes with new features that bear close watching.

Take the rise of “pre-sales.” In this practice, someone on X urges people to send funds to a crypto address in exchange for a yet-to-be-launched memecoin.

‘They think they’re winning big, and then get absolutely destroyed.’

— Taylor Monahan, MetaMask

Unlike the initial coin offerings of yore, memecoin pre-sales don’t offer up a white paper or even attempt to pitch a working product.

And many memecoins appear to be pump-and-dump schemes on warp speed, say analysts.

“You go to DEX Screener, and you see new pairs, and within the hour, they go up, and they go down,” said Edward Wilson, Nansen’s social media lead and member of the analytics firm’s trend-spotting division, like new memecoins, told DL News.

“It’s very much a scam.”

$149 million in SOL

Pre-sales also take advantage of the FOMO — fear of missing out — coursing through the bull market.

One token named after the blood sugar drug Ozempic attracted 5,000 SOL, worth $925,000, in deposits before it launched on the Base network.

Onchain sleuth ZachXBT tabulated some $149 million in SOL tokens sent to addresses advertised in pre-sales last month.

I was interested to see how much SOL has been sent as a result of the presale meta and calculated >655,000 SOL ($122.5M) raised from 27 presales. pic.twitter.com/dvsW4TSoov

— ZachXBT (@zachxbt) March 19, 2024

“It’s all super low-key exploitative and most brutal for the folks who ride in on the exuberance,” said Monahan.

“They think they’re winning big, and then get absolutely destroyed. They’re the silent majority.”

Dogecoin spawn

The irony is that memecoins originated as a warning of sorts.

In 2013, Jackson Palmer and Billy Markus created what’s believed to be the market’s first memecoin — Dogecoin — as a critique of the industry’s rampant speculative nature.

Today, DOGE is valued at more than $26 billion, making it the industry’s ninth-largest cryptocurrency. The pooch with a beanie also spawned packs of dog coins and even the patronage of Elon Musk.

Monahan did praise memecoins as an expression of one of the industry’s core tenets: permissionless finance.

“As much as I bash memecoin shenanigans, it would be objectively worse they didn’t — or couldn’t — exist,” she told DL News.

“The magic of crypto is that its core design actually serves literally everyone.”

Nansen’s Wilson added that memecoins make pretty good community-building tools, too.

He said Zyncoin, a popular memecoin built around the eponymously named nicotine pouches, boasts a relatively modest valuation of $45 million.

This form of “tokenised culture” offers something else to supporters — a platform for sharing stories of being addicted to nicotine.

“People love the memes,” Wilson said. “They buy the token and they enjoy that kind of community and celebrate that.”

are memecoins “culture” ?

— pastel ← leo ꓽꓽ) (@pastelETH) April 3, 2024

Wilson acknowledged that memecoins don’t exactly lend themselves to any modicum of asset analysis.

Bitcoin has a proposition of being a store of value, like gold.

But Memecoins?

“You can’t do price analysis; there’s nothing like that,” Wilson said. “It’s about attention, fundamentally. There are ways to build communities around these memecoins that rally around that attention.”

Effectively Ponzis

Wilson was quick, though, to add that there is another kind of memecoin, which he calls “effectively Ponzis.”

That’s because exponential gains generated by memecoins have attracted all types of players with aggressive tactics.

When tokens soar, much like Solana did last month, it can spawn “a lot more unsophisticated players with far too much money on hand” to start betting on new coins they can throw on the blockchain network, Monahan said.

“To be clear, I personally do not consider memecoins to be peak innovation.”

Some have made made serious money trading memecoins by managing to outrun thin trading on exchanges before prices plummet.

“Even if you do get really lucky and get really rich overnight, you’re not special. This is crypto,” said Monahan. “You’re still an openly greedy kid who got lucky on memes.”

Others haven’t been as good with their timing.

Since peaking on March 10, SWIFTIES on Solana has plummeted more than 95%.

That’s fine, though, says Monahan.

“This is literally play money to them and they are playing. They could lose it all and would still be up 10 times or 100 times.”

Liam Kelly is DL News’ Berlin correspondent. Contact him at liam@dlnews.com.