Tether’s USDT closes in on pre-bear market cap

Tether’s USDT stablecoin has almost recouped all market value lost in the 2022 bear market.

USDT’s market cap reached $81.5 billion Sunday, compared to an $83 billion high last May when Terra/Luna’s collapse kicked of a chain of events that saw several major crypto firms crash.

USDT’s dominance — a DefiLlama metric comparing USDT market cap to that of all other stablecoins — is also at a high not seen since last April, at 62.2%.

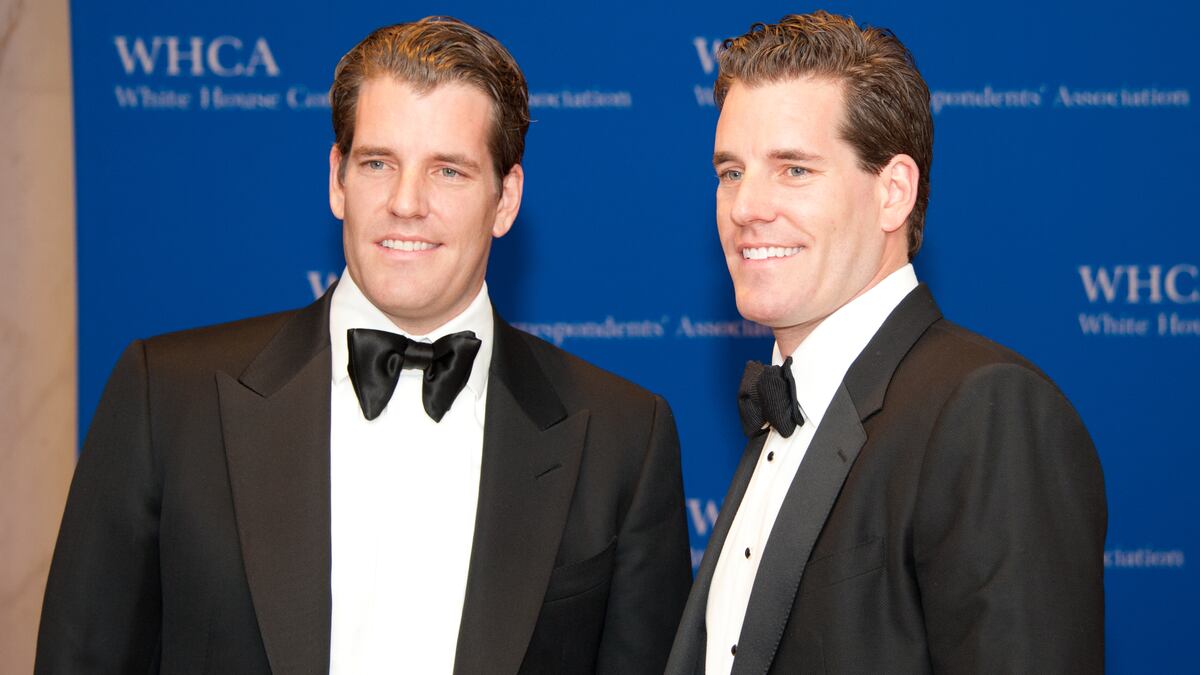

Gemini launches non-US BTC derivative product amid regulations woes

Gemini will expand into non-US derivatives as regulatory hurdles in America persist, the crypto exchange said on Friday.

The new perpetual Bitcoin futures contract will fall under the moniker Gemini Foundation. It will be denominated in Gemini dollars.

Rival exchange Coinbase also expressed interest in setting up shop outside the US last week.

Both announcements came as Stateside regulatory uncertainty continues to rattle the crypto industry.

With Congress being no closer to ratifying new crypto laws, regulators like the Securities and Exchange Commission have increased their efforts to regulate by enforcement actions.

The US situation stands in stark contrast to the EU where the European Parliament rubber-stamped the Markets in Crypto-Assets bill into law last week.

NOW READ: ‘Not a warm and fuzzy guy:’ Gary Gensler’s past sheds light on his firm stance on crypto

KuCoin Twitter hacked and customers scammed out of assets

Crypto exchange KuCoin had its Twitter account hacked Sunday, with reports of asset losses verified by the exchange in a Twitter thread.

KuCoin’s account was recovered within an hour of the security breach, but the window allowed scammers to make 22 transactions which involved customers.

The company pledged to reimburse customers affected by the hack, and assured the public that Kucoin’s platform was unaffected.

Dear KuCoin users,

— KuCoin Updates (@KuCoinUpdates) April 23, 2023

We are sorry to inform you that our official Twitter account has been compromised, and we are taking measures to resolve the issue as soon as possible.

Please do not click on any suspicious links shared through our account

Bankrupt lender Celsius up for sale Tuesday in three-way auction

A three-way auction for crypto lender Celsius will take place Tuesday, with major industry firms Coinbase and Gemini each backing their own bidders. Celsius filed for Chapter 11 bankruptcy last summer. It owed creditors $4.7 billion.

Asset manager NovaWulf had previously been selected as the so-called stalking horse bidder — a role that gave it an inside track to taking over Celsius.

Now, filings reveal that two new groups — Coinbase-backed Farhenheit, and the Blockchain Recovery Investment Committee, which has ties to Gemini Trust — have also thrown their hats in the ring for a slice of Celsius’ carcass.

NOW READ: Arrest of Turkey’s failed crypto exchange boss kicks off hunt for answers

Scaramucci doubts an FTX reboot could happen

Financier and former White House Director Anthony Scaramucci said he doubts that recent hints of an FTX reboot are possible in a Sunday interview.

Scaramucci pointed towards challenges faced by exchanges in 2023, with low volumes and tight balance sheets cause for concern even for healthy exchanges.

FTX lawyers teased the potential for a reboot of the firm earlier this month, contingent on a restructuring plan that would take effect next year.

NOW READ: Europe’s MiCA crypto law green-lighted in aim to end ‘Wild West’

Yuga Labs wins judgement in Ryder Ripps lawsuit

Bored Apes NFT creator Yuga Labs has won a victory in its lawsuit against NFT creators Ryder Ripps and Jeremy Cahen, with a California judge awarding the firm a partial summary judgement.

Yuga Labs’s case is centred around Ripps and Cahen’s alleged copycat RR/BAYC NFT project, which satirised the popular Bored Apes project and alleged racist undertones including Nazi associations.

Yuga denied the allegations and sued for “creating customer confusion,” due to similarities in art design and domain names.

Yuga Labs is seeking $200,000 in statutory damages, but the judge determined damages will be determined in a pending trial.

US presidential hopefuls rally against a digital dollar ahead of 2024 elections — Bloomberg

Trust wallet fixes vulnerability after $170,000 in user losses, plans reimbursements — The Block

More Chinese government employees will be paid in digital yuan: report — Decrypt