- Winklevoss slams SEC ETF refusals as “disaster.”

- Vitalik Buterin says FTX founder’s lack of vision was a “red flag.”

- This and much more in today’s Snapshot.

Happy Monday!

This weekend, we saw the Winklevoss twins — of Facebook fame — take another stab at the US Securities and Exchange Commission, and Ethereum founder Vitalik Buterin revealed the big “red flag” he had about disgraced FTX founder Sam Bankman-Fried.

Winklevoss slams SEC ETF refusals as ‘disaster’

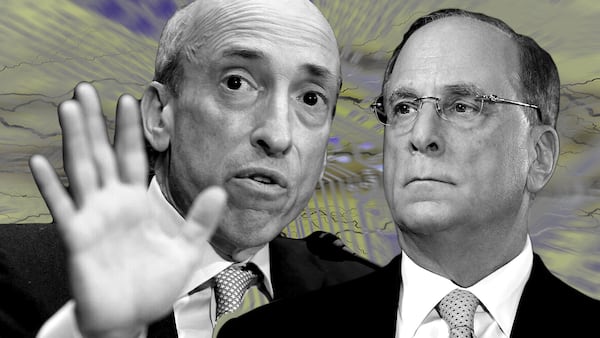

Cameron Winklevoss, co-founder of crypto exchange Gemini with his brother Tyler, took to Twitter on Sunday. He labelled the market watchdog’s refusal so far to approve spot Bitcoin exchange-traded funds as “a complete and utter disaster for US investors and demonstrates how the SEC is a failed regulator.”

The outburst came 10 years after the twins filed for a spot Bitcoin ETF, and on the back a string of firms including Fidelity and BlackRock filing to launch similar products.

Vitalik Buterin says FTX founder’s lack of vision was a ‘red flag’

Buterin rejected the idea that disgraced FTX founder Sam Bankman-Fried was respected among the crypto community before the collapse of the exchange when he appeared on the The Aarthi and Sriram Show this weekend.

Vitalik said that what “stood out as a red flag on FTX” and SBF was that “he was not just able to articulate a vision of why crypto is good” and that he was only “regurgitating” what had “been said by influencers for years.”

Poly Network hopes ‘attacker will cooperate’

Another day, another crypto hack. Poly Network has become the victim of a digital heist that affected 57 crypto assets across 10 blockchains on July 2, according to the protocol.

In a string of tweets on Sunday, the cross-chain bridge platform urged cybersecurity experts to come to its aid and that it hoped “the attacker will cooperate and return the user assets to avoid any potential legal consequences.”

Crypto investment drops by 70%

There is an air of thaw in the crypto winter after financial Goliaths like BlackRock and Fidelity announced plans to muscle further into the industry. However, new figures from data provider RootData shows that venture capital investments into the sector dropped by over 70% between June 2022 and the same month this year.

Investment fell from $1.81 billion across 149 rounds in June last year to $520 million across 83 rounds for June 2023. Or to put it this way: despite all the market bullishness and Bitcoin rallies, monthly VC investments are at their lowest point in the past 12 months.

Aave votes to freeze TrueUSD reserves

DeFi protocol Aave’s community voted to freeze the TrueUSD reserve on the Wave V2 Ethereum pool following “recent events with the TUSD asset.”

The proposal didn’t clarify what events it was referring to, but TrueUSD was recently revealed to have a small exposure to defunct off-ramp provider Prime trust.

Over 561,000 Aave community members, representing about 84% of the vote, backed the proposal.

What we’re reading from around the web

Meet the 9 power players shaping the UK’s growing crypto agenda — The Block

CBDC skepticism is strong in Canada and England, too — Decrypt

AI will help crypto get to the next level — Forbes